A 30-day budget is a practical, beginner-friendly framework that helps you take control of your money, build confidence in money decisions, and establish a foundation you can trust. If you’re new to personal finance, this guide is ideal for budgeting for beginners. Start by listing all income sources, then categorize fixed costs such as housing and utilities, and finally identify discretionary areas where small cuts can yield meaningful gains without sacrificing daily comfort. As you progress, dedicate a few minutes each day to tracking expenses, comparing actuals to your budget, and noting where adjustments are needed to keep the plan viable. By month’s end, you’ll have a practical budget that adapts to changes in income, priorities, and life circumstances, and you’ll be ready to apply what you’ve learned to future cycles.

Another way to see it is as a month-long money plan that clarifies where every dollar goes, turning complex finance talk into actionable steps. Think of it as a monthly budgeting routine that emphasizes monitoring expenses, prioritizing needs, and building small, sustainable savings, all designed to make financial topics feel approachable. By using related terms such as expense tracking, cash-flow plan, and habit-based money management, this approach aligns with search intent while reinforcing the core idea of prudent financial planning.

Creating a 30-day budget: A Practical Guide for Budgeting for Beginners

Starting a 30-day budget is a foundational step in personal finance basics. For budgeting for beginners, the first move is to identify your income and essential expenses, then set a realistic plan that doesn’t require expensive tools or complex formulas. A simple structure—income, fixed costs, and discretionary spending—provides a clear path to tracking expenses and building toward savings or debt payoff. This approach also aligns with how to build a budget, emphasizing consistency and the right mindset over perfection.

Choosing a budgeting method that fits your life is key. Zero-based budgeting and the 50/30/20 rule both work well for a 30-day budget, ensuring every dollar has a purpose and supporting steady progress toward goals. By focusing on budgeting for beginners, you can see tangible results within weeks, learn where your money goes, and form healthy money habits that survive life changes. Start with rough numbers, then refine as you learn your actual spending and income patterns.

Tracking Expenses and Personal Finance Basics with a 30-day budgeting plan

Tracking expenses daily is the heartbeat of a successful 30-day budgeting plan. Use a simple notebook, spreadsheet, or budgeting app to log every dollar as you earn and spend. This practice turns theory into action, reinforces personal finance basics, and gives you concrete visibility into where your money goes each day. Regular tracking helps you identify patterns, catch leaks, and stay motivated as you move through the plan.

As you progress through the 30-day budgeting plan, you’ll spot opportunities to trim costs without sacrificing essential needs. Review weekly, adjust categories, and reallocate funds toward savings or debt payoff. Remember that tracking expenses isn’t about punishment; it’s about empowerment—providing momentum to sustain healthy budgeting habits beyond the initial 30 days and laying the groundwork for more advanced strategies if you choose to pursue them.

Frequently Asked Questions

What is a 30-day budget and why is it a good fit for budgeting for beginners?

A 30-day budget is a beginner-friendly, month-long plan to map your income, essential expenses, and discretionary spending so you can clearly see where your money goes. It supports the basics of personal finance and helps you build a solid budgeting habit. To start, list all income, track fixed and variable expenses, and choose a simple method (such as zero-based budgeting or the 50/30/20 rule). Set clear goals for the month and commit to daily tracking. By month’s end, you’ll have a practical budget and a clearer money picture you can reuse as life changes.

How can I start a 30-day budgeting plan and track expenses effectively?

To begin a 30-day budgeting plan, gather data on income and all expenses, then categorize them into essentials and discretionary spending. Choose a budgeting method you can sustain, such as zero-based budgeting or the 50/30/20 rule, and set realistic monthly goals for savings or debt payoff. Track expenses daily using a simple spreadsheet or budgeting app, review actuals weekly, and adjust upcoming weeks as needed. This approach emphasizes tracking expenses, supports budgeting for beginners, and builds confidence in managing money through practical steps.

| Topic | Key Points |

|---|---|

| Introduction | A 30-day budget is beginner-friendly; it provides a clear plan, consistency, and the right mindset to build a practical budget you can reuse. |

| Why a 30-Day Budget Matters | Creates a focused, time-bound path to financial clarity; lowers intimidation; daily recording builds discipline; reveals spending patterns. |

| Foundations | Need income, fixed expenses, and irregular costs; average irregular costs monthly; seed money for discretionary spending, savings, and debt repayment. |

| Choosing a Budgeting Method | There isn’t a single “best” method; options include Zero-based budgeting and the 50/30/20 rule; choose one you can sustain and stay consistent. |

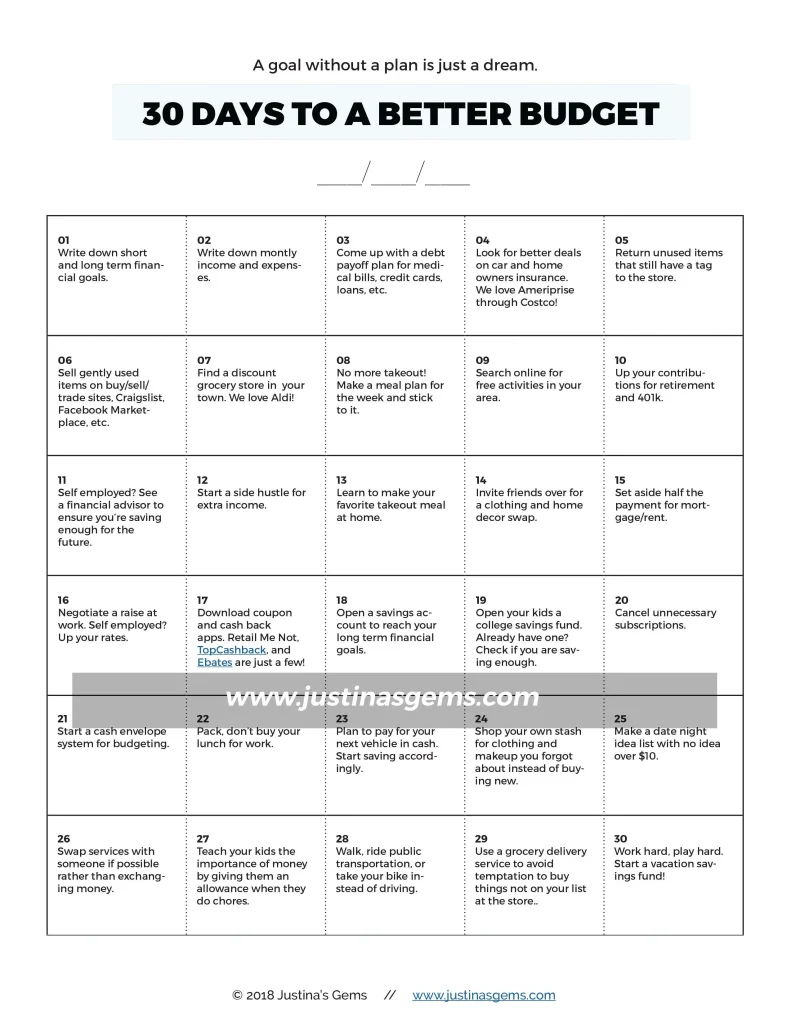

| Day-by-Day Plan | Days 1-7: data gathering and goals; Days 8-14: build categories; Days 15-21: track and adjust; Days 22-30: assess and plan next cycle. |

| Practical Tips | Start with rough numbers; prioritize needs; build an emergency buffer; automate savings; track expenses; use a simple tool you’ll actually use. |

| Common Pitfalls | Underestimating irregular expenses; ignoring small charges; overly rigid targets; not reviewing progress. |

| Tools and Templates | Spreadsheets, budgeting apps, paper trackers, and reminders help you stay on track with minimal complexity. |

| Measuring Progress | Momentum from completing the 30-day budget; identify trends, stay consistent, and progressively improve; layer in advanced tactics later. |

Summary

With a well-executed 30-day budget, you begin a foundation for lasting financial clarity and control. This approach helps you see exactly where money goes, forms the habit of daily tracking and weekly review, and unlocks opportunities to save and pay down debt. By the end of the 30 days, you’ll have a practical budget you can reuse as life changes, a clearer picture of spending patterns, and a scalable framework that supports ongoing financial goals. If you stay curious, patient, and consistent, the 30-day budget becomes a stepping-stone toward more ambitious financial milestones and everyday empowerment.