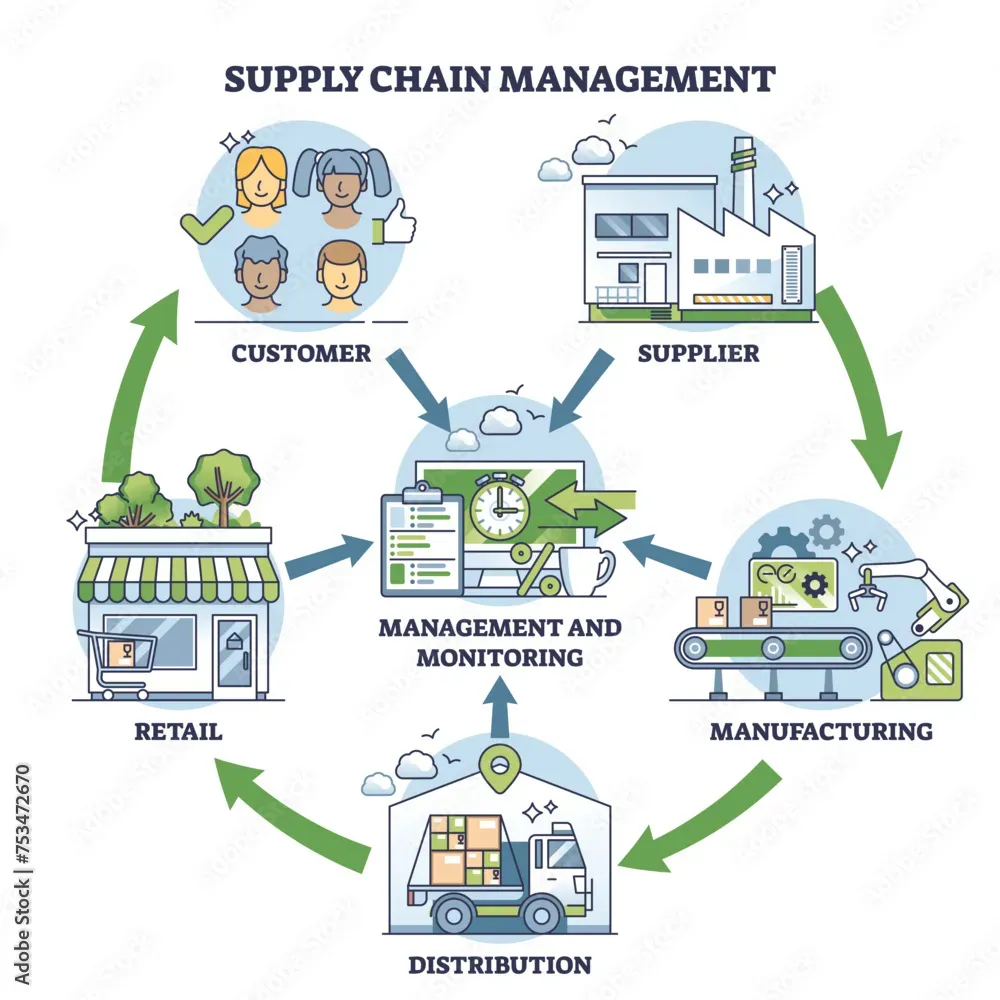

Stocks to Supply Chains sits at the center of today’s business narrative, linking how a company’s stock moves to the health of its global logistics. Understanding stock market trends alongside supply chain disruptions reveals how operational hiccups ripple into earnings and valuations. From the warehouse floor to investor dashboards, global supply chain insights help translate daily news into long-term strategies. For readers of business news analysis, the linkage is a practical lens for assessing risk, resilience, and potential upside. This holistic view shows how supply chain strategies and financial signals reinforce smarter decision-making for executives and investors alike.

Viewed through an equity-signal lens, the link between stock-price dynamics and supply networks reflects how logistics health shapes returns. In line with Latent Semantic Indexing (LSI) principles, the discussion uses alternative terms such as the equity-to-value chain nexus to show how bottlenecks, transportation costs, and supplier stability recalibrate investor expectations. Analysts often discuss resilience metrics, end-to-end visibility, and demand-supply synchrony when describing how a company’s operations inform its market trajectory. By examining operational indicators—lead times, inventory turns, and freight spreads—alongside capital-market chatter, readers gain a more nuanced picture than earnings alone. This approach helps marketers and investors connect logistics discipline with shareholder value, without getting lost in jargon.

Stocks to Supply Chains: Reading Financial Signals Through Operational Health

Stocks to Supply Chains ties a company’s stock trajectory to the health of its operational network. In practice, investors follow stock market trends that reflect how well a business manages supplier risk, lead times, and logistics costs, especially when macro shocks hit the system. This perspective helps interpret earnings momentum, cash flow visibility, and equity volatility through the lens of supply chain performance.

When a port backlog or freight-rate spike squeezes margins, the hit often shows up first in delivery times and cost structures. That is where supply chain strategies—dual sourcing, supplier diversification, nearshoring, and strategic stock buffers—become visible in the financials, influencing how the market prices risk and rewards resilience. Business news analysis increasingly seeks these operational signals to explain shifts in share prices and earnings guidance.

Investors also monitor global supply chain insights such as inventory turnover, days of inventory on hand, and supplier risk dashboards. Real-time visibility tools and predictive analytics help distinguish structural improvements from temporary noise, reinforcing the link between supply chain health and long-term stock performance.

From Disruptions to Profits: How Global Supply Chain Insights Shape Stock Market Trends

Global supply chain insights shed light on how disruptions ripple into earnings and stock market trends. When logistics costs rise or a component faces shortages, analysts assess whether pricing power, productivity gains, or supplier diversification can sustain margins and cash flow. This analysis helps explain why the stock may re-rate on resilience rather than merely on top-line growth.

Digital visibility platforms, AI-driven demand forecasting, and supplier risk dashboards are increasingly read as indicators of durable competitive advantage. Investors interpret these tools as signals of operational efficiency, which can support steadier revenue recognition and a more resilient stock trajectory in the face of global supply chain disruptions.

For managers, insights into supply chain strategies translate into concrete actions—nearshoring, automation, supplier development programs, and inventory optimization—while for investors, they inform risk assessment and potential multiple expansion. In this way, business news analysis moves from isolated headlines to a cohesive narrative about how supply chain capabilities underpin earnings quality and market valuation.

Frequently Asked Questions

What does “Stocks to Supply Chains” mean, and how do stock market trends reflect supply chain disruptions?

Stocks to Supply Chains is a framework that links a company’s supply chain health to its stock performance. Stock market trends often react to the severity and duration of supply chain disruptions, which impact delivery times, costs, margins, and earnings visibility. By watching indicators like supplier diversification, inventory levels, and freight costs, investors can gauge resilience and anticipate how disruptions may shape returns, leveraging global supply chain insights in pricing.

How can investors use global supply chain insights and supply chain strategies to interpret business news analysis about Stocks to Supply Chains?

Investors should focus on how business news analysis ties earnings guidance, capital spending, and strategic pivots to supply chain factors. Track supply chain strategies such as nearshoring, dual sourcing, and inventory optimization, and compare peers to separate cyclicality from durable improvements. Use these signals to interpret stock implications, including margins, cash flow, and long-term value, within the Stocks to Supply Chains framework.

| Key Point | Summary |

|---|---|

| Definition: What Stocks to Supply Chains means | A framework linking macro forces to earnings and stock prices through supply chain health. |

| Why the link is more visible now | Disruptions are more visible and longer-lasting; costs broaden beyond labor; digital tools improve visibility; investors seek resilience. |

| Role of the latest business news | Earnings guidance, capex plans, and strategic pivots are tied to supply chains; stock moves react to logistics investments or delays. |

| Disruptions and market implications | Lead times, freight and energy costs affect margins and revenue timing; supplier risk increases stock volatility; inventory management matters. |

| Global supply chain insights to watch | Regional supplier diversification, digital maturity, resilience-focused capital allocation, and trade/currency dynamics shape stock trajectories. |

| Interpreting news through a supply-chain lens | Assess whether supply chain improvements signal revenue stability or if higher costs imply pricing or margin pressure. |

| Investor strategy | Track stock market trends alongside supply chain indicators; compare peers to separate cyclicality from structural improvements. |

| Manager strategy | Strengthen supplier relationships, pursue dual-sourcing, use digital twins, and consider nearshoring to reduce risk and improve predictability. |

| Scenario planning | Create best/base/worst-case demand scenarios and model how supply-chain responses affect earnings and cash flow; communicate scenarios transparently. |

| Real-world scenarios | Examples include component shortages in electronics or faster omnichannel fulfillment shifts improving long-term revenue momentum. |

| Takeaways for 2025 | Monitor end-to-end supply chain health, value resilience, invest in transparency, balance efficiency with flexibility, and align with macro context. |

Summary

Stocks to Supply Chains highlights how financial performance and supply-chain health are two sides of the same coin. The latest business news connects stock moves to operational realities—sourcing, manufacturing, and delivery—driving investors and managers to weigh resilience, visibility, and cost dynamics when assessing earnings and value. By reading headlines through a supply-chain lens, readers can better anticipate margins, cash flow, and risk, translating information into smarter decisions about investments and strategy.