Entrepreneurship Roadmap guides founders from idea to scalable venture with a practical, battle-tested framework that invites experimentation while demanding discipline and thoughtful risk management for sustained momentum. By weaving customer insight, product development, financial planning, governance, and clear decision rights into a single ongoing process, it helps teams translate fuzzy concepts into repeatable, measurable, high-velocity progress that stakeholders can track. The approach emphasizes core entrepreneurial principles, grounding strategy in a clear value proposition, sustainable unit economics, a customer-centric value ladder, and a model that scales with demand across markets. Funding decisions are purposefully aligned with milestones, spanning bootstrap capital, angel or seed investments, and deliberate use of startup funding strategies to extend runway and maximize value for founders across teams and stakeholders. The roadmap foregrounds scalable growth, urging deliberate channel selection, efficient onboarding, strong retention, and monetization that supports long-term profitability and resilience in competitive markets, even amid rapid change.

From another angle, this concept can be described as a startup blueprint for turning early insight into a scalable company. It emphasizes a venture-development plan that covers customer validation, rapid prototyping, go-to-market readiness, and disciplined capital use to reach the next milestone. Alternative terms like an entrepreneurial playbook, business growth framework, or go-to-market strategy reflect the same core idea: aligning product value with investor milestones. By using related terms and semantically linked topics such as customer discovery, revenue models, unit economics, and capital planning, the discussion remains comprehensive for readers and search engines alike.

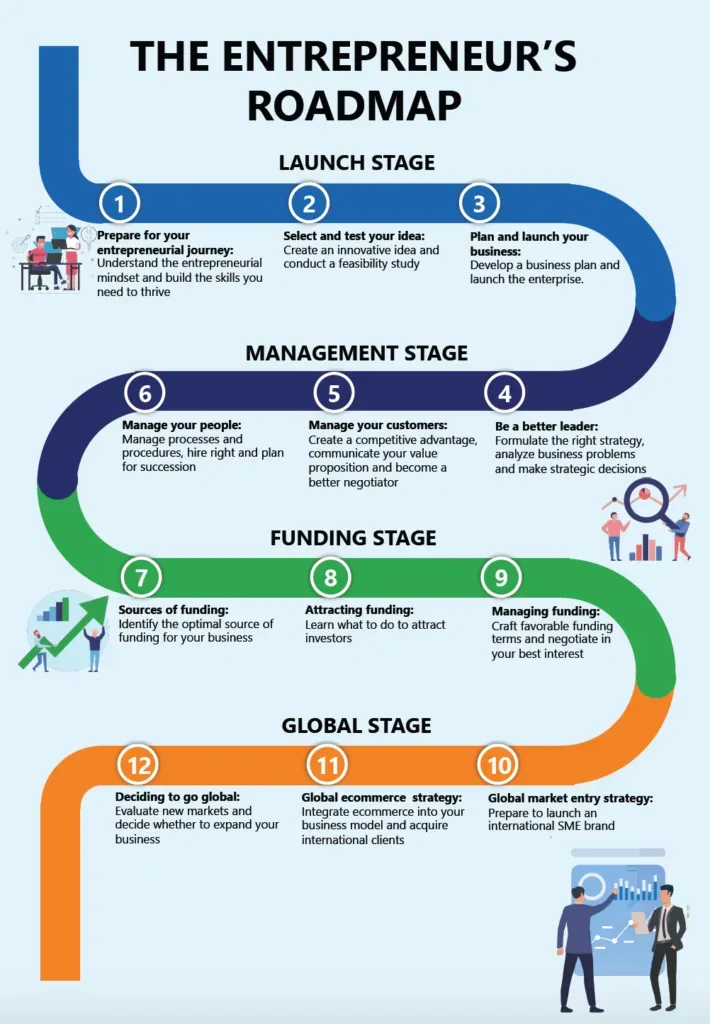

Entrepreneurship Roadmap: Foundations, Funding, and Growth for the Fundamentals of Entrepreneurship

The Entrepreneurship Roadmap is a practical, battle-tested framework that helps founders move from a rough idea to a scalable business. It’s a living process that weaves together customer insight, product development, financial planning, and disciplined growth, all anchored in the fundamentals of entrepreneurship. By aligning funding options with a clear business model and rigorous execution, founders can reduce risk, improve decisions, and increase their odds of long-term success.

Foundations begin with answering core questions: what problem am I solving, for whom, and why is my solution better than the alternatives? The fundamentals of entrepreneurship include achieving product‑market fit, delivering a compelling value proposition, building a repeatable business model, and setting a path to sustainable profitability. Early validation—gathering real feedback from real customers and iterating—drives product design, pricing, and messaging in a continuous loop.

A scalable model shows how value converts to revenue, which channels drive acquisition, and how margins improve as the company grows. Milestones and metrics—CAC, lifetime value (LTV), churn, monthly recurring revenue (MRR), and gross margin—provide a practical dashboard for forecasting, planning, and risk management. When funding is tied to these milestones, the roadmap becomes a guide for investor conversations and disciplined resource allocation, ultimately supporting robust business planning for startups.

Funding and Growth Playbook for Startups: From Bootstrapping to Securing Venture Capital and Beyond

Funding is a strategic resource, not a hurdle. The path from bootstrapping to venture capital should align with your growth plan, capital needs, and the velocity at which you can reach meaningful milestones. The playbook of startup funding strategies spans self-funded growth, customer-funded momentum, angel investments, seed funds, and venture capital, each with trade-offs in control, speed, cost, and strategic value. A precise capital plan determines how much is needed to reach the next milestone and which milestones unlock the best value for both founders and investors.

Growth strategies for startups require a balanced, focused approach—prioritizing a few channels that deliver meaningful traction, paired with a strong onboarding experience and clear value realization. Product-market fit remains central as markets evolve, driving iterative adjustments to pricing, packaging, and go-to-market tactics. Efficient growth also means improving unit economics, optimizing supply chains, and investing in scalable infrastructure, while aligning talent, culture, and governance to support rapid execution and sustainable profitability. Securing venture capital can accelerate scaling when milestones and defensible unit economics are in place, and a clear plan for use of funds, hiring, and product development helps in navigating term sheets and ownership discussions.

A comprehensive business planning for startups document acts as a living narrative that evolves with learnings and market conditions. It should outline the use of funds, hiring plans, product development priorities, and measurable milestones that de-risk the business for future rounds. When the roadmap integrates non-dilutive funding options and strategic partnerships, founders can extend runway while preserving equity, ensuring the organization stays focused on long-term value creation and sustainable growth.

Frequently Asked Questions

What is the Entrepreneurship Roadmap and how does it support choosing startup funding strategies?

The Entrepreneurship Roadmap is a practical framework that blends the fundamentals of entrepreneurship with deliberate funding decisions. It helps founders align business planning for startups with the right startup funding strategies, from bootstrapping and grants to angel investments and venture capital. By linking customer insight, product development, and key metrics (CAC, LTV, MRR) to funding needs, it guides a living plan that evolves as you reach product-market fit and scale.

How does the Entrepreneurship Roadmap guide growth strategies for startups seeking to secure venture capital?

The Entrepreneurship Roadmap guides growth strategies for startups by turning product iteration, customer acquisition, retention, and monetization into a repeatable engine. It emphasizes focused growth and a credible path to profitability, which is essential when pursuing securing venture capital. It also supports business planning for startups by outlining the use of funds, go-to-market priorities, and scalable operations, helping founders demonstrate traction to investors.

| Section | Key Points |

|---|---|

| Foundations: The Fundamentals of Entrepreneurship | Identify the problem and target customer; articulate value proposition; define a scalable business model; establish milestones and metrics (CAC, LTV, churn, MRR, gross margin); conduct ongoing customer validation to inform product design, pricing, and messaging; build a repeatable, profitable engine. |

| Funding: From Bootstrapping to Venture Capital | Choose funding options aligned with stage and goals (bootstrapping, customer-funded growth, angels, seed funds, VC); consider non-dilutive options (grants, competitions, government programs); develop a living business plan; determine capital needs to reach milestones; balance control, speed, and cost of capital. |

| Growth: Growth Strategies for Startups | Balance product iteration with customer acquisition, retention, and monetization; focus on a few high-impact channels; ensure strong onboarding and value realization; maintain product-market fit through iterative testing; improve unit economics and margins as scale grows; align people, culture, and structure for execution. |

| Securing Venture Capital and Beyond | Align financing with milestones; build a compelling pitch deck and demonstrate traction; present problem, go-to-market, demand, scalable model, and data-driven growth projections; understand term sheets, equity, and governance; establish credibility through a clear narrative and advisory network. |

| Creating a Roadmap that Works | Synthesize fundamentals, funding, and growth into a practical plan; start with problem-solution and monetization path; map funding to milestones and market feedback; plan quarterly objectives, resources, forecasts, and contingencies; use real-world examples to illustrate execution. |

| Common Pitfalls | Overbuilding before validating the market; mismanaging cash flow; chasing funding without a clear plan; neglecting customer success; losing focus on fundamentals and milestones. |