earnings reports reshaping the stock landscape have become the compass for investors navigating a volatile market. Behind every beat or miss lies more than numbers; it signals shifts in risk appetite and guides capital across sectors, shaping the market reaction to earnings reports. The earnings season impact on stocks becomes evident as guidance, margins, and growth trajectories reframe what investors expect for the next several quarters. For traders and long-term holders alike, how earnings reports affect stock prices is a mix of surprise, narrative credibility, and the durability of cash flow. This dynamic often yields stock volatility after earnings as markets reassess value and position for the next phase of the cycle.

In other words, quarterly earnings announcements are a barometer of corporate health, signaling how investors re-price risk and reprioritize portfolios. From a semantic perspective, this topic maps to related ideas such as market sentiment shifts, profit disclosures, and valuation reset rather than any single metric. The phrase earnings reports reshaping the stock landscape can be understood as part of a broader pattern of price discipline and sector leadership driven by cash flow durability. By focusing on guidance quality, cash flow generation, and margin trends, readers can anticipate how earnings figures influence investor behavior in a changing macro environment. These insights complement the more technical discussion of stock volatility after earnings and market reaction to earnings reports, offering a balanced view of what comes next.

Earnings Reports Reshaping the Stock Landscape: Implications for Investors

Earnings reports reshaping the stock landscape refers to more than a single beat or miss. It describes how investors reassess risk, reallocate capital, and reset price expectations across sectors as quarterly disclosures accumulate. The broader story is not just about company-by-company news but about how the collective earnings picture helps map where durable growth, margin discipline, and strong guidance may drive leadership or where caution is warranted.

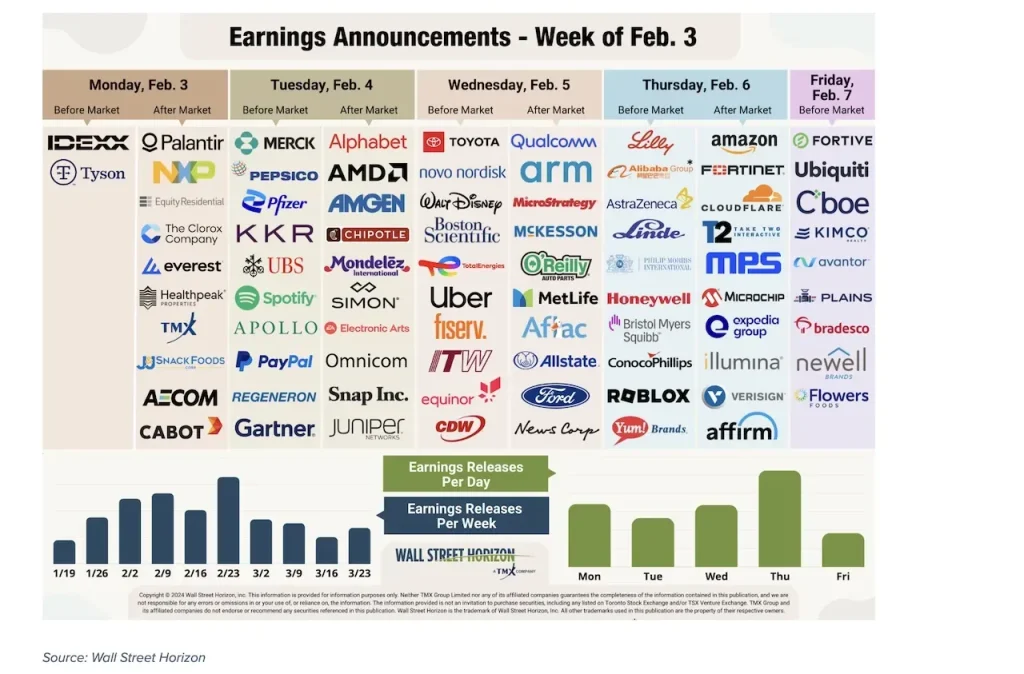

As earnings season unfolds, the earnings season impact on stocks becomes more visible, influencing how investors price risk and select leadership names. In practice, this means watching not only the earnings results themselves but also how management frames future scenarios, how buyers and sellers price in macro headwinds, and how sector dynamics shift as multiple names report in a short window. How earnings reports affect stock prices is shaped by profitability trajectories, cash flow signals, and the credibility of forward-looking guidance that underpins price discovery across markets.

Market Dynamics After Earnings: How Earnings Reports Affect Prices and Volatility

The market reaction to earnings reports captures how quickly prices react to new information. A positive surprise can spark a swift rally, while a soft print or conservative guidance can trigger rapid re-pricing. In the current environment, investors compare results against consensus estimates and evaluate the credibility of management’s narrative within the broader context of inflation, rates, and demand trends—demonstrating how earnings reports influence stock prices.

Beyond direction, earnings events inject volatility into trading desks. Stock volatility after earnings often reflects changes in forward expectations and implied volatility as options traders price the near-term uncertainty. In addition to the numbers, the tone of guidance and the visibility of free cash flow help determine whether the stock continues its trend or experiences a pullback as investors recalibrate risk across the portfolio.

Frequently Asked Questions

How do earnings reports reshaping the stock landscape influence the market reaction to earnings reports?

Earnings reports reshaping the stock landscape change how investors assess risk, price expectations, and sector leadership after quarterly disclosures. The market reaction to earnings reports hinges on guidance credibility, margin durability, and revenue trajectory. A solid report with credible forward guidance can lift a stock and shift leadership, while a miss or cautious outlook can trigger volatility or price resets even if the long‑term case remains intact. In this context, traders focus on management tone, sustainability of cash flow, and whether profits translate into durable value, helping explain rapid shifts in market leadership after earnings.

What is the earnings season impact on stocks, and how do earnings reports affect stock prices and volatility?

During the earnings season, the impact on stocks varies by sector and company quality. Markets react to earnings surprises versus expectations and to the implied path of future earnings, which shapes stock prices. A positive surprise with credible guidance can push prices higher, while misses often lead to target revisions and higher volatility. Stock volatility after earnings is common as investors digest both the numbers and the narrative, and options pricing typically reflects elevated implied volatility around the event. Practical takeaways include focusing on earnings quality, margins, cash flow, and macro context, while diversifying to manage post‑earnings risk.

| Key Point | Description |

|---|---|

| What earnings reports reveal and why they matter |

|

| Market reaction to earnings reports |

|

| Earnings season impact on stocks across sectors |

|

| How earnings reports affect stock prices and volatility |

|

| Case studies and patterns worth noting |

|

| The role of guidance and narrative in shaping the landscape |

|

| Practical takeaways for investors and traders |

|

| Strategic implications for portfolios in a post-earnings world |

|

| Risks and considerations |

|

Summary

earnings reports reshaping the stock landscape will remain a central driver of price discovery in modern markets. By understanding how earnings translate into market reactions, how sector dynamics shift after quarterly disclosures, and how management guidance informs price trajectories, investors can navigate volatility with greater confidence. The most successful approaches balance earnings quality with prudent risk management and a focus on the longer-term business narrative.