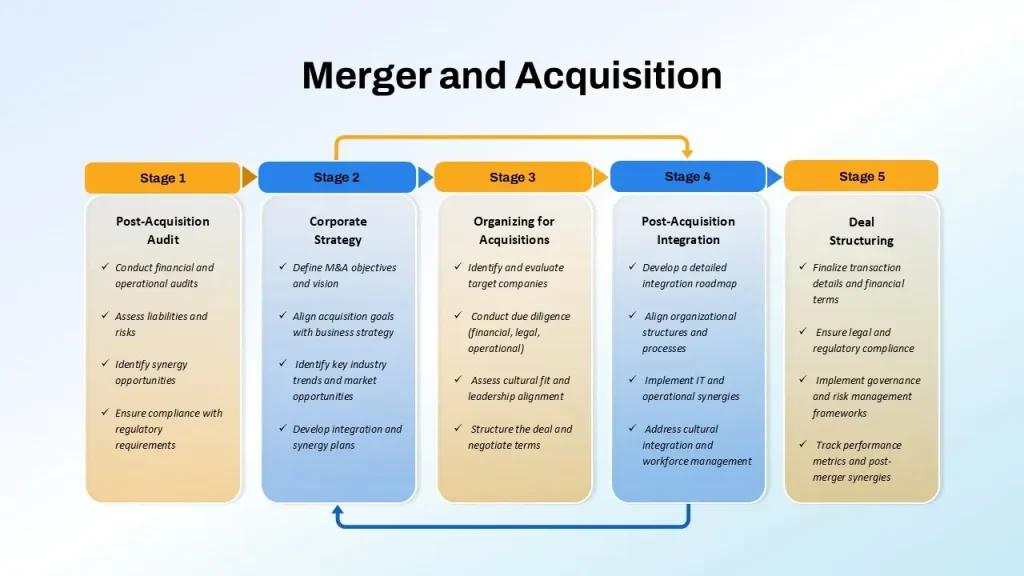

Mergers and Acquisitions Strategy acts as a disciplined framework for growth, guiding target evaluation, deal structuring, and value realization across the enterprise, from initial screening through integration, and helping leadership translate complex market signals into coherent action, while establishing clear ownership for milestones and accountable governance. In today’s dynamic markets, executives rely on Mergers and Acquisitions trends to anticipate opportunities, align initiatives with corporate strategy, and prioritize high-potential combinations, while keeping a keen eye on capital allocation, regulatory considerations, and the evolving competitive landscape, and building organizational capabilities that support seamless integration across functions, markets, and channels. From cross-border mergers to domestic consolidations, sound strategy demands rigorous due diligence, clear governance, and a vivid integration plan that preserves value through transition, supported by scenario planning, stakeholder alignment, and disciplined post-merger metrics. Leading indicators such as synergy realization in M&A and measurable revenue and cost synergies should be embedded in financial models from day one, complemented by governance rituals, milestone-based tracking, and disciplined risk management across functions. This introductory overview sets the stage for a practical exploration of how strategy, people, and disciplined execution translate deal activity into durable competitive advantage, while signaling how M&A news and trends influence future planning and performance.

A modern approach to growth combines mergers, acquisitions, and strategic partnerships into a coordinated playbook for market expansion. This alternative framing emphasizes disciplined target evaluation, thorough due diligence, and post-close integration—often described as an integration blueprint for value realization and organizational change. By concentrating on cross-border deals, cross-functional alignment, and scalable operating models, firms translate strategic ambitions into tangible competitive advantages and sustainable shareholder value.

Mergers and Acquisitions Strategy: Aligning Corporate Strategy for Sustainable Growth

A Mergers and Acquisitions Strategy acts as a disciplined framework that guides target selection, integration planning, and value realization. By anchoring deal activity in the broader corporate strategy, executives can translate Mergers and Acquisitions trends into actionable priorities and ensure that each transaction advances long‑term growth objectives. In the current M&A news cycle, the emphasis is shifting from deal size to the quality of strategic fit and post‑merger execution, making strategy-driven filtering essential for sustainable value creation.

Practically, this approach means mapping target profiles to strategic milestones, assessing both revenue and cost synergies, and building robust financial models that stress different integration scenarios. It also foregrounds governance and due diligence as value levers, with a clear path to synergy realization in M&A and a detailed plan for PMI (post‑merger integration). When these elements align, the organization preserves value across the transition and accelerates competitive differentiation.

Cross-Border Mergers Strategy: Navigating Global Markets and Synergy Realization in M&A

Cross-border mergers expand geographic reach, access to talent, and customer footprints, but they introduce regulatory complexity, currency volatility, and cultural diversity. An effective Cross-border Mergers Strategy begins with early engagement with local authorities and a governance model tailored to multi‑jurisdiction operations, ensuring the corporate strategy remains coherent across borders. By watching M&A trends and staying informed through M&A news, leaders can anticipate regulatory shifts and adapt synergy realization plans accordingly.

Realizing value in cross-border deals requires a detailed PMI blueprint that addresses operating-model standardization, talent retention, and cross‑border process integration. Integrated risk management, data governance, and clear KPIs for revenue and cost synergies are essential to track progress and maintain execution discipline. When the integration is designed to align with the enterprise’s corporate strategy, geographic expansion translates into durable competitive advantage rather than a short‑term headline.

Frequently Asked Questions

How does Mergers and Acquisitions Strategy align corporate strategy with M&A trends to optimize synergy realization in M&A?

Mergers and Acquisitions Strategy is a disciplined framework for selecting targets, validating strategic fit, and structuring deals to create value. It aligns with corporate strategy by linking capability gaps, geographic expansion, and core competencies to target profiles and by estimating revenue and cost synergies. By tracking Mergers and Acquisitions trends, it informs when and where to pursue deals while keeping integration readiness front and center. Crucially, it embeds synergy realization in M&A into the post-merger integration (PMI) plan, with clear operating models, KPIs, and governance to realize revenue and cost synergies and to preserve value through the transition.

What are essential best practices for cross-border mergers under Mergers and Acquisitions Strategy?

Best practices for cross-border mergers under Mergers and Acquisitions Strategy include early engagement with local regulators, clear governance for the merged entity, and a realistic integration blueprint that accounts for cultural and talent differences. Teams should assess currency risk, tax implications, and regulatory contingencies during due diligence, and design deal structuring to manage cross-border risk. Align cross-border deals with corporate strategy, and build PMI teams and KPIs that track geography-specific synergies (revenue, cost) and integration milestones. Stay attuned to M&A news and trends to anticipate regulatory or market changes, and maintain flexible integration plans to realize synergy realization in M&A over time.

| Element | Key Points |

|---|---|

| Focus Keyword | Mergers and Acquisitions Strategy |

| Related Keywords | – Mergers and Acquisitions trends – M&A news – corporate strategy – cross-border mergers – synergy realization in M&A |

| Post Title | Mergers and Acquisitions Strategy: Insights for 2025 |

| Meta Description | Mergers and Acquisitions Strategy: Explore latest M&A news, trends, cross-border deals, and how corporate strategy drives synergy realization for growth. |

| Key Themes | Understanding the Current Landscape: Mergers and Acquisitions Trends and M&A News – value creation through strategic fit, integration planning, risk reduction; Aligning Corporate Strategy with M&A Activity – strategy as north star; Cross-Border Mergers – complexities and opportunities; Due Diligence, Valuation, and Deal Structuring; Post-Merger Integration; Risk Management and Governance; Sector-Specific Perspectives; Future Outlook |

| Conclusion (from Base Content) | A robust Mergers and Acquisitions Strategy emphasizes rigorous alignment with corporate strategy, thorough due diligence, disciplined integration, and strong governance to realize long-term value and sustainable growth, including cross-border considerations. |

Summary

Table summarizes the base content about Mergers and Acquisitions Strategy, including focus keyword, related keywords, title, meta description, and key thematic sections from the blog post and conclusion.