Mergers and Innovation Strategy reframes what a corporate deal can deliver, turning balance-sheet consolidation into a driver of ongoing growth, value creation, and durable competitive advantage across products and markets. By aligning leadership’s strategic vision with a disciplined pace of experimentation, it expands value beyond cost synergies to create new capabilities, markets, and customer experiences, while embedding performance metrics and governance that sustain momentum through integration milestones. In practice, firms harness an innovation in M&A mindset to map product roadmaps, data platforms, and go-to-market moves that neither company could unlock alone, building a joint platform and ecosystem that accelerates R&D cycles. A well-designed approach emphasizes due diligence with an innovation lens, governance for cross-functional teams, and a culture that embraces rapid learning, psychological safety for experimentation, and clear pathways for talent retention and leadership development. Ultimately, Mergers and Innovation Strategy helps leaders translate deal momentum into sustained competitive advantage, resilience, and ongoing value creation for customers, shareholders, and employees as the merged entity navigates regulatory environments and global markets.

Viewed through the lens of strategic combinations, the conversation shifts from short-term cost savings to integration-led growth and innovation-driven transformation. When leaders design the post-close roadmap around co-developed offerings, shared platforms, and unified customer journeys, the merged organization gains velocity in markets neither could reach alone. Latent semantic indexing suggests speaking in related terms such as alliance-driven growth, platform convergence, and culture-enabled collaboration to signal intent while keeping content natural. A governance blueprint that blends agile product development, talent retention, and disciplined risk management ensures the transformation remains customer-focused and financially disciplined. In this way, the integration becomes a catalyst for renewed value, turning consolidation into a platform for experimentation, learning, and sustainable competitive advantage. The result is a roadmap that not only captures financial outcomes but also accelerates product-market fit, talent development, and customer value through shared learning loops. By treating the merger as a platform for experimentation rather than a one-off transaction, leaders can sustain momentum through governance, metrics, and ongoing alignment with the broader corporate strategy. This approach translates into tangible benefits for customers, shareholders, and employees, while reducing risk by embedding learning, adaptation, and iterative improvements into every phase of integration.

Mergers and Innovation Strategy: Turning Deals into Growth Engines

Across current mergers and acquisitions trends, the value of a deal is seldom realized by cost synergies alone. The Mergers and Innovation Strategy framework embeds an active innovation program into the integration plan, ensuring the combined entity develops new capabilities, markets, and customer experiences that neither company could achieve alone. When executives align this approach with corporate innovation strategies, the merger becomes a growth engine rather than a balance-sheet event.

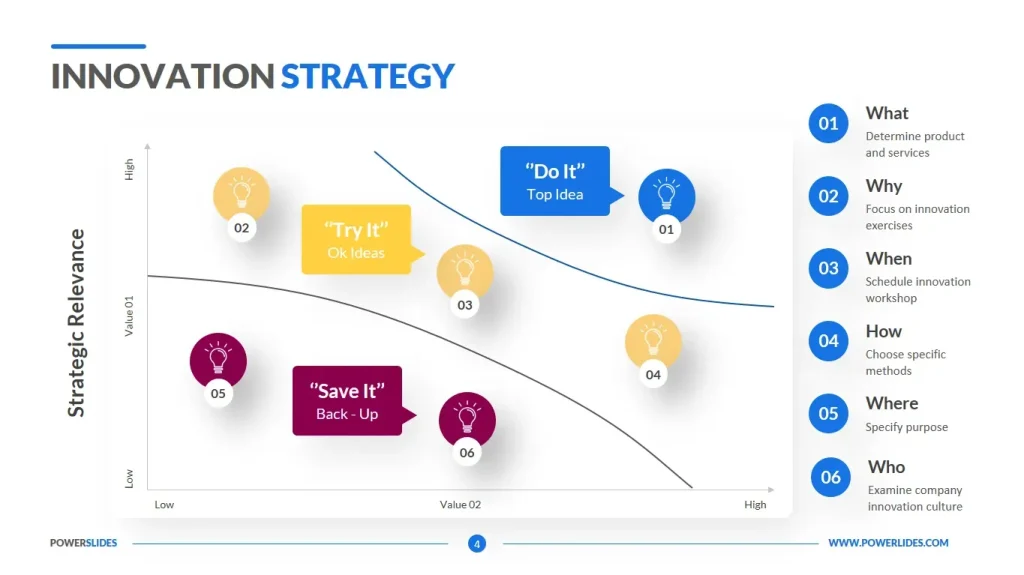

Key components include thorough due diligence with an innovation lens, a clear value map that links strategy to execution, culture alignment, and integrated product and tech roadmaps. By applying merger integration best practices and treating innovation in M&A as a core discipline, leaders build a roadmap where product roadmaps, platforms, and data assets unlock new revenue streams and competitive differentiation.

Executing with Insight: A Playbook for Innovation-Driven Post-Merger Value

To translate the strategy into sustainable outcomes, governance, risk management, and disciplined cadence must be designed around both business strategy and mergers. This means data governance, cross-functional decision rights, and regular program reviews that keep the innovation agenda on track as the organization absorbs the new capabilities and customers. In this way, innovation stays central to value realization even as integration accelerates.

Practical steps focus on a product-led integration, standardized operating rhythms, and a metrics system that tracks time-to-market, platform adoption, and cross-sell momentum. By centering the playbook on innovation in M&A and using a staged integration with early wins, the merged company can sustain momentum, improve customer value, and weather regulatory and competitive challenges.

Frequently Asked Questions

How do mergers and acquisitions trends shape corporate innovation strategies during merger integration?

Current mergers and acquisitions trends emphasize rapid digital transformation, AI, cloud, cybersecurity, and cross-border activity, which makes embedding a Mergers and Innovation Strategy essential. From due diligence to integration, apply an innovation lens to identify tech gaps, culture risks, and new capability opportunities, not just cost savings. Develop a value map that links the combined strategy to execution, detailing target capabilities, customer segments, and go-to-market changes. Align culture, governance, and cross-functional teams to support experimentation, shared platforms, and phased milestones. Measure success with metrics that capture both financial outcomes and innovation progress, such as time-to-market, platform adoption, and cross-sell improvements, so the deal becomes a source of sustainable growth.

What merger integration best practices drive innovation in M&A while aligning with business strategy and mergers?

Begin with an innovation-centric integration plan that ties product roadmaps and technology platforms to the new business strategy. Apply merger integration best practices such as phased milestones, unified data governance, and standardized operating rhythms to enable rapid experimentation without disrupting customers. Establish a governance model with cross-functional product teams, architecture discipline, and clear decision rights to accelerate joint development and platform consolidation or interoperability. Prioritize culture alignment early with shared values and effective change management to speed adoption and reduce friction. Implement a robust measurement framework that tracks both financial outcomes and innovation metrics—such as time-to-market, platform adoption, and new offerings—to demonstrate the value created by the M&A.

| Aspect | Key Points | Notes / Examples |

|---|---|---|

| Definition and Purpose | Mergers and Innovation Strategy turns balance-sheet consolidation into lasting competitive advantage; convergence acts as a catalyst for new capabilities, markets, and efficiencies; the focus extends beyond cost synergies to growth, culture, and momentum after the deal closes. | Foundation for strategic integration and ongoing innovation. |

| Market Landscape and Trends | Rapid digital transformation, cross-border opportunities, regulatory scrutiny, and the race to acquire capabilities in AI, cloud, cybersecurity, and data analytics. | Favors strategic combinations that accelerate innovation velocity. |

| Strategic Focus | Balance the short-term financial rationale with a longer-term capability map for the merged entity. | Leaders pair due diligence with a deliberate innovation agenda to outpace competitors and adapt to shifting customer needs. |

| Why Innovation Matters | Innovation is a primary driver of value realization; integrate product roadmaps, technology platforms, and customer experiences to unlock new markets. | Embed an innovation program into the integration plan to identify and fund new offerings and reimagine business models. |

| Key Components | 1) Comprehensive due diligence with an innovation lens; 2) A clear value map linking strategy to execution; 3) Culture alignment and change management; 4) Integrated product and tech roadmaps; 5) Merger integration best practices for execution; 6) Metrics and accountable leadership. | These components ensure tech debt, culture, governance, and execution align with the combined strategy. |

| Innovation at Center of Value Realization | Innovation-centered operating model; continuous experimentation with new business models, monetization strategies, and data-driven services. | This approach sustains growth amid disruption and helps attract top talent. |

| Case Illustrations | SaaS + data analytics: build a joint analytics platform, harmonize data standards, accelerate AI-driven features; co-development partnerships. | Consumer goods + logistics tech: digitize supply chains, enable predictive demand forecasting, invest in sustainable packaging; new revenue models. |

| Leadership, Governance & Frameworks | Clear strategic intent, aligned incentives, robust governance; cross-functional leadership; program reviews; rapid experimentation. | Prevents stagnation and maintains momentum across the integration. |

| Tools, Frameworks & Best Practices | Value realization planning; data and platform integration; product-led integration; change management playbooks; risk management with light-touch governance. | Guides practical execution and maintains agility. |

| Risks & Mitigation | Overpaying for synergies; cultural integration challenges; complexity of technology integration. | Mitigation: rigorous due diligence with an innovation lens; phased integration with early wins; continuous learning loops. |

| The Future | Digital capabilities, data-driven decision-making, and agile cross-border collaboration; speed to value with disciplined governance; intersection of mergers and innovation as growth opportunities. | A forward-looking view of how Mergers and Innovation Strategy will shape competitive advantage. |