Entrepreneurship KPIs serve as a clear compass for founders, turning vague ambition into tangible signals that guide decisions, priorities, and resource allocation across every function of a fast-growing venture. In practical terms, these indicators reveal where a business stands, how efficiently it uses capital, and which pivots will unlock sustainable progress instead of chasing vanity metrics that drain time and morale. This framework translates a flutter of momentum into concrete actions, helping founders align time, funding, and energy with the bets that produce real leverage in the market and a healthier unit economics profile. From the outset, teams should track a targeted mix such as startup metrics, revenue growth KPIs, and burn rate and runway to stay aligned with the business model, growth stage, and the expectations of investors. By tethering these metrics to product development, customer acquisition, and sales execution, founders can diagnose bottlenecks early and adjust strategy to drive sustainable, scalable growth while preserving cash runway.

Viewed through plain language, these concepts are startup performance indicators that measure market fit, operating efficiency, and financial resilience for a new venture. Think of them as founder KPIs expressed in dashboards that track customer acquisition cost, retention, and cash flow, offering a real-time view of progress without relying on vanity counts. In practice, this LSI-informed framing helps teams connect product decisions to customer value, channel performance to revenue potential, and cost management to runway longevity.

Entrepreneurship KPIs: Aligning Revenue Growth KPIs with Startup Metrics and Burn Rate

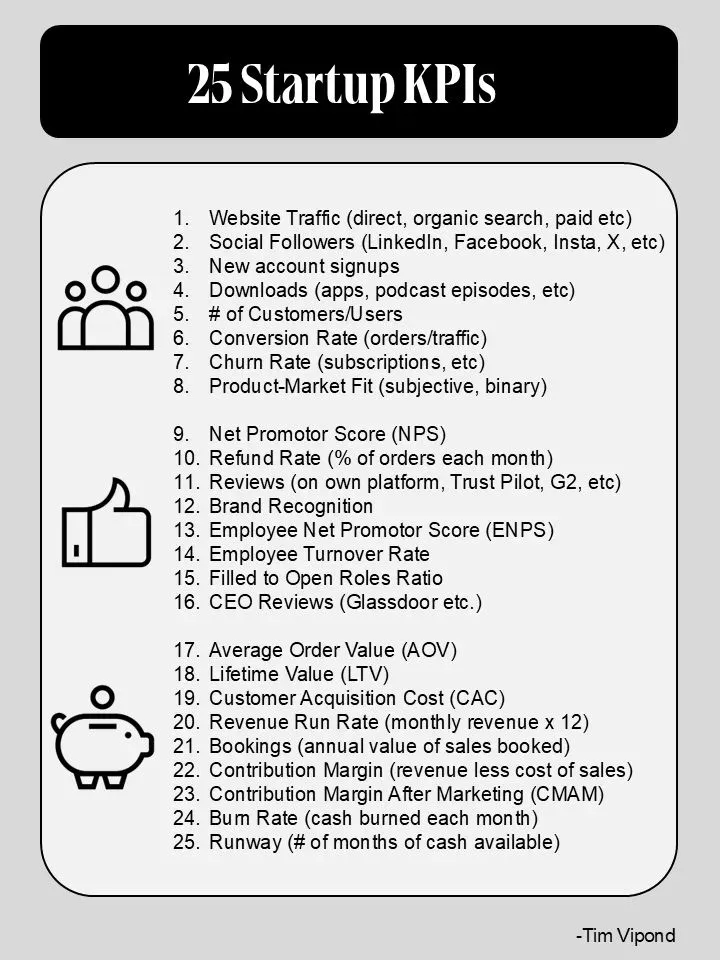

In entrepreneurship, prioritizing a tight set of indicators helps founders steer the venture with clarity. Entrepreneurship KPIs should connect revenue growth KPIs to core startup metrics—tracking how fast revenue expands while assessing the health of the funnel, activation, and onboarding. By monitoring burn rate and runway alongside customer acquisition cost (CAC) and lifetime value (LTV), you can see not just growth, but whether expansion is sustainable under current capital consumption. A dashboard that links MRR/ARR growth to channel performance, go-to-market efficiency, and product-market fit turns momentum into actionable bets.

To implement effectively, define precise formulas and targets: for example, CAC = total sales and marketing spend divided by new customers in a period; CAC payback period = gross margin per customer divided by CAC; and LTV relative to CAC. Track revenue growth KPIs month over month, segment by market or channel, and tie outcomes to product iterations. Prioritize metrics that inform pricing, onboarding improvements, and channel investments. Avoid vanity metrics—focus on startup metrics that illuminate unit economics and the burn rate so you can plan capital needs and strategic pivots.

CAC, LTV, Onboarding, and Runway: Optimizing Growth Efficiency for Scalable Revenue

Balancing customer acquisition cost with long-term value is essential for scalable growth. This involves watching CAC payback and ensuring LTV covers CAC within a reasonable timeframe aligned with your burn rate and runway. When CAC increases or payback stretches beyond your runway, you should reallocate marketing spend, improve conversion and onboarding, or optimize pricing to accelerate value realization. Keeping an eye on churn and engagement helps lift LTV, and a strong onboarding process often predicts higher retention and longer customer lifetimes.

Implement a practical, cross-functional KPI system by sourcing data from CRM, billing, analytics, and product usage telemetry. Define exact calculations for each KPI and build a data dictionary to avoid ambiguity. Set stage-appropriate targets and establish a consistent reporting rhythm to support decision-making. Run experiments—pricing tests, onboarding redesigns, or channel diversification—and measure their impact on CAC, LTV, churn, and revenue growth KPIs. The goal is a lean, founder-friendly metric suite that protects runway while driving sustainable growth.

Frequently Asked Questions

What are the essential Entrepreneurship KPIs to track, including startup metrics and revenue growth KPIs?

Entrepreneurship KPIs focus on three layers: growth indicators, efficiency indicators, and health indicators. Track revenue growth KPIs to measure market traction and pricing impact; monitor startup metrics such as funnel health, activation rate, and time-to-value to identify onboarding bottlenecks; and assess efficiency with CAC and CAC payback, plus LTV. Burn rate and runway help gauge liquidity and fundraising needs. Use reliable data sources, define precise calculations, and review dashboards regularly to translate metrics into strategic actions.

How can founders manage CAC, burn rate, and runway within their founder KPIs to sustain revenue growth?

Founders should balance CAC, burn rate, and runway within Entrepreneurship KPIs to support sustainable growth. Calculate CAC as total sales and marketing spend divided by new customers, and track CAC payback period to ensure payback happens within your available runway. If CAC rises or payback lengthens, adjust marketing spend, optimize onboarding, or improve conversion to strengthen unit economics. Monitor burn rate and runway to time fundraising and preserve liquidity while pursuing revenue growth, and connect CAC and LTV with retention to sustain scalable growth.

| Aspect | Description |

|---|---|

| Entrepreneurship KPIs — Definition and purpose | A focused set of indicators that reveal where a business stands, how efficiently it uses capital, and where to pivot; they translate momentum into actions. |

| Three KPI buckets (Growth, Efficiency, Health) | KPIs are grouped to measure growth, efficiency, and sustainability, avoiding vanity metrics. |

| Revenue growth KPIs | Track revenue expansion over time and tie it to product iterations, market segments, or channels to identify leverage. |

| Startup metrics and funnel health | Map the customer journey and monitor funnel conversion at each stage to reveal bottlenecks and opportunities. |

| CAC and CAC payback period | Measure acquisition cost and how long to recover it with gross profit; informs spend, onboarding, and pricing decisions. |

| LTV and retention KPIs | Estimate total revenue per customer; compare with CAC to assess profitability; retention and engagement clarify long-term value. |

| Burn rate and runway | Monthly cash consumption and runway indicate how long you can operate at current burn, guiding fundraising and cost management. |

| Operational margins (gross and contribution) | Gross margin measures profitability after direct costs; contribution margin reflects profitability after variable costs. |

| Churn, retention, and engagement | Churn shows customer loss; retention and engagement reveal product stickiness and recurring revenue health. |

| Net new ARR or MRR | For recurring models, tracks progress in acquiring and expanding contracts; isolates new business vs upgrades. |

| Activation and onboarding metrics | Measures the moment a user gains value; better onboarding correlates with higher retention and lifetime value. |

| Funnel velocity and cycle time | Sales cycle length and time-to-value impact win rates and growth trajectories. |

| Implementation of KPI tracking | Source data from CRM, billing, analytics; define calculations; build a data dictionary; set dashboards and cadence. |

| Common pitfalls | Avoid vanity metrics; keep a lean KPI set; prevent data silos; review and adapt metrics quarterly. |

Summary

Entrepreneurship KPIs are the compass founders use to navigate uncertainty and focus on the metrics that truly drive growth. By concentrating on growth indicators, efficiency indicators, and health indicators, startups can measure progress without chasing vanity numbers. Revenue growth KPIs reveal whether revenue is expanding and how it aligns with pricing, market segments, and go-to-market channels. Startup metrics and funnel health illuminate bottlenecks in the customer journey from awareness to monetization, helping teams optimize messaging and channels. CAC and CAC payback period assess the sustainability of growth by showing how quickly acquisition costs are recovered. LTV and retention KPIs forecast profitability and signal whether product-market fit and retention justify spending. Burn rate and runway highlight cash scarcity and guide fundraising and cost management. Margins (gross and contribution) show where profitability sits and how much can be reinvested. Churn, retention, and engagement provide a window into product stickiness and revenue predictability. Activation and onboarding metrics connect the user experience to long-term value, while funnel velocity and cycle time emphasize sales efficiency. Implementing KPI-tracking requires clean data sources, clear calculations, targets, dashboards, and regular reviews. When used well, Entrepreneurship KPIs turn data into decisions, helping founders adapt strategy and build a sustainable, scalable business.