Airbnb earnings report for the first quarter signals a mixed bag for investors, revealing results that met market expectations while casting a shadow over the company’s revenue forecast. Released just after the market’s close on Thursday, the report indicated that while Airbnb’s quarterly results aligned closely with analysts’ predictions, concerns about a downturn in travel from Canada to the U.S. emerged. With a reported revenue of $2.27 billion, which is a notable 6% increase from the previous year, the company nevertheless projected a revenue range of $2.99 billion to $3.05 billion for the second quarter—a forecast that fell short of analyst expectations. This forecast disappointment contributed to a sharp decline in shares by over 5%, as investors digested the implications of weaker travel demand. As Airbnb navigates the complexities of evolving travel trends and economic uncertainties, its earnings performance analysis is crucial for stakeholders keen on understanding the company’s path ahead.

The recent financial disclosures from Airbnb reveal a nuanced picture of its operations during the first quarter, highlighting both promise and challenges ahead. The recent Airbnb Q1 earnings brought to light new dynamics within the vacation rental market, with analysts dissecting their quarterly results to understand future growth potential. Amid discussions on Airbnb’s revenue forecast, industry observers are particularly interested in emerging travel trends and how they might influence bookings in the coming months. As Airbnb adapts to these variables, the performance analysis aims to uncover insightful patterns that could shape its strategies. Ultimately, understanding these financial indicators is vital for gauging Airbnb’s resilience and responsiveness to market demands.

Airbnb Q1 Earnings: An Overview

Airbnb’s first-quarter earnings report revealed a performance that aligned closely with analysts’ expectations, with earnings per share coming in at 24 cents, exactly matching forecasts. The company reported a revenue of $2.27 billion, slightly surpassing the anticipated $2.26 billion. This marks a 6% increase in revenue compared to last year’s $2.1 billion, indicating continued demand for Airbnb’s services despite mounting economic challenges. However, a noted decline in net income, which dropped to $154 million from $264 million year-over-year, raises questions regarding operational efficiency and profitability.

Despite the generally positive earnings results, the outlook for the second quarter appears less optimistic. Airbnb projected a revenue range between $2.99 billion and $3.05 billion, which is notably lower than the $3.04 billion expected by analysts. This discrepancy was further exacerbated by indications of reduced travel activity, particularly from Canadian guests to the U.S., which the company attributed to economic uncertainties affecting consumer spending and travel habits. As a result, shares plummeted by over 5%, reflecting investor concerns about Airbnb’s short-term revenue growth potential.

Frequently Asked Questions

What were the highlights of the Airbnb Q1 earnings report?

Airbnb’s Q1 earnings report revealed earnings per share of 24 cents, matching analyst expectations, and a revenue of $2.27 billion, slightly surpassing the forecast of $2.26 billion. However, the company reported a decline in net income compared to the same quarter last year.

How does Airbnb’s revenue forecast for Q2 compare to analyst expectations?

Airbnb projected its revenue for the second quarter to be between $2.99 billion and $3.05 billion, estimating $3.02 billion at the midpoint, which was below analysts’ expectations of $3.04 billion.

What are the key takeaways from Airbnb’s performance analysis in Q1?

Airbnb’s performance analysis for Q1 showed a 6% year-over-year revenue growth to $2.27 billion. Though gross booking value increased by 7% to $24.5 billion, there were challenges with softer travel from Canada to the U.S., reflecting broader economic uncertainties.

What factors contributed to Airbnb’s decline in net income reported in the earnings report?

Airbnb’s Q1 net income decreased to $154 million, down from $264 million in the previous year, largely due to rising operational costs and economic pressures that affected travel trends.

How did the Easter timing impact Airbnb’s Q2 revenue forecast?

Airbnb indicated that its Q2 revenue would benefit from a two-percentage-point boost due to the Easter holiday, which saw strong demand, especially from Latin America.

What insights were provided about Airbnb travel trends in recent reports?

Airbnb noted a notable rise in nights booked in March, particularly an increase of 27% from Canadian guests traveling to Mexico. However, trends also showed a moderation in bookings expected for the current quarter compared to Q1.

What can investors expect during the upcoming Airbnb earnings call?

During the upcoming earnings call, Airbnb executives are expected to address the financial results, discuss upcoming platform updates, and provide further insights into travel trends and revenue projections in light of current economic conditions.

How do Airbnb’s quarterly results indicate growth despite challenges?

Airbnb’s quarterly results show year-over-year growth with a 6% increase in revenue and an 8% rise in nights booked. However, they also indicate notable challenges such as a slowdown in travel from Canada and broader economic uncertainties affecting performance.

What impact did the market reaction have on Airbnb after the earnings report?

Following the release of its Q1 earnings report and revenue forecast that fell short, Airbnb’s shares dropped over 5%, reflecting investor concerns about future growth amid current economic uncertainties.

What changes has Airbnb made to its platform according to the latest earnings report?

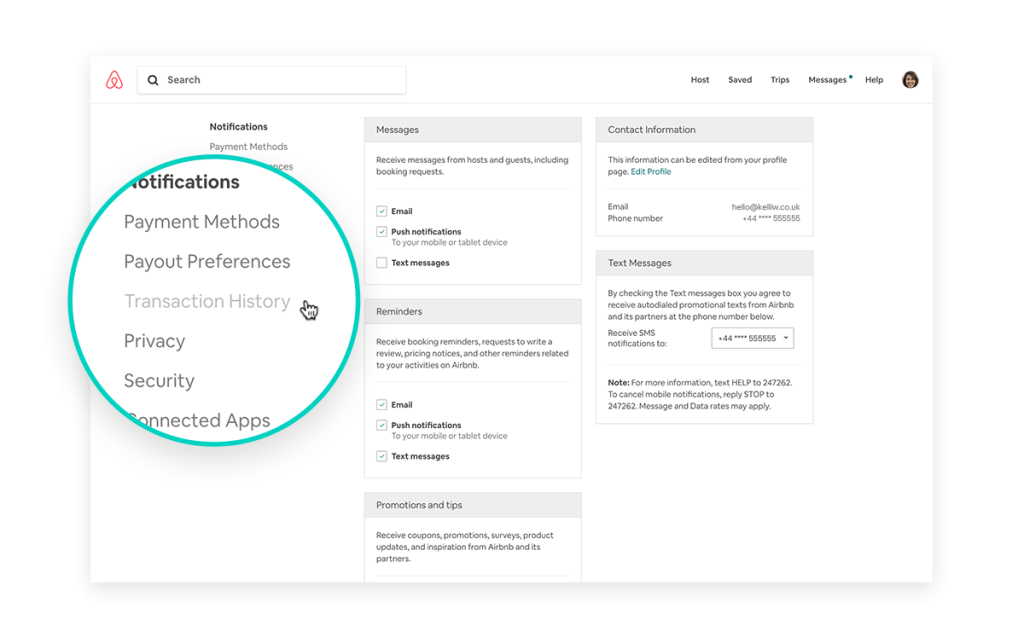

Airbnb announced the removal of 450,000 listings as part of its quality control enhancements and plans to introduce new platform updates aimed at improving user experience and expanding beyond accommodations.

| Metric | Q1 2023 Results | Forecasts & Insights |

|---|---|---|

| Earnings per Share (EPS) | $0.24 | $0.24 expected |

| Revenue | $2.27 billion | $2.26 billion expected |

| Year-over-Year Revenue Growth | 6% | Increased from $2.1 billion last year |

| Net Income | $154 million (24 cents/share) | Down from $264 million (41 cents/share) last year |

| Projected Q2 Revenue | $2.99 – $3.05 billion | $3.04 billion expected |

| Growth in Gross Booking Value | 7% year-over-year | $24.5 billion total |

| Nights & Experiences Booked | 143.1 million | 143.4 million estimated |

| Canadian Guests Visiting Mexico | 27% increase in March | Year-over-year observation |

Summary

The recently released Airbnb earnings report highlights key financial metrics that reflect the company’s performance in the first quarter of 2023. While earnings per share met analyst expectations, the revenue outlook for the second quarter has raised concerns among investors, leading to a notable drop in share price. Moreover, despite overall growth, there was a reported softness in travel demand, especially concerning cross-border bookings from Canada to the U.S. This complex picture of robust growth coupled with caution for the upcoming quarter captivates attention as Airbnb navigates a challenging economic landscape.