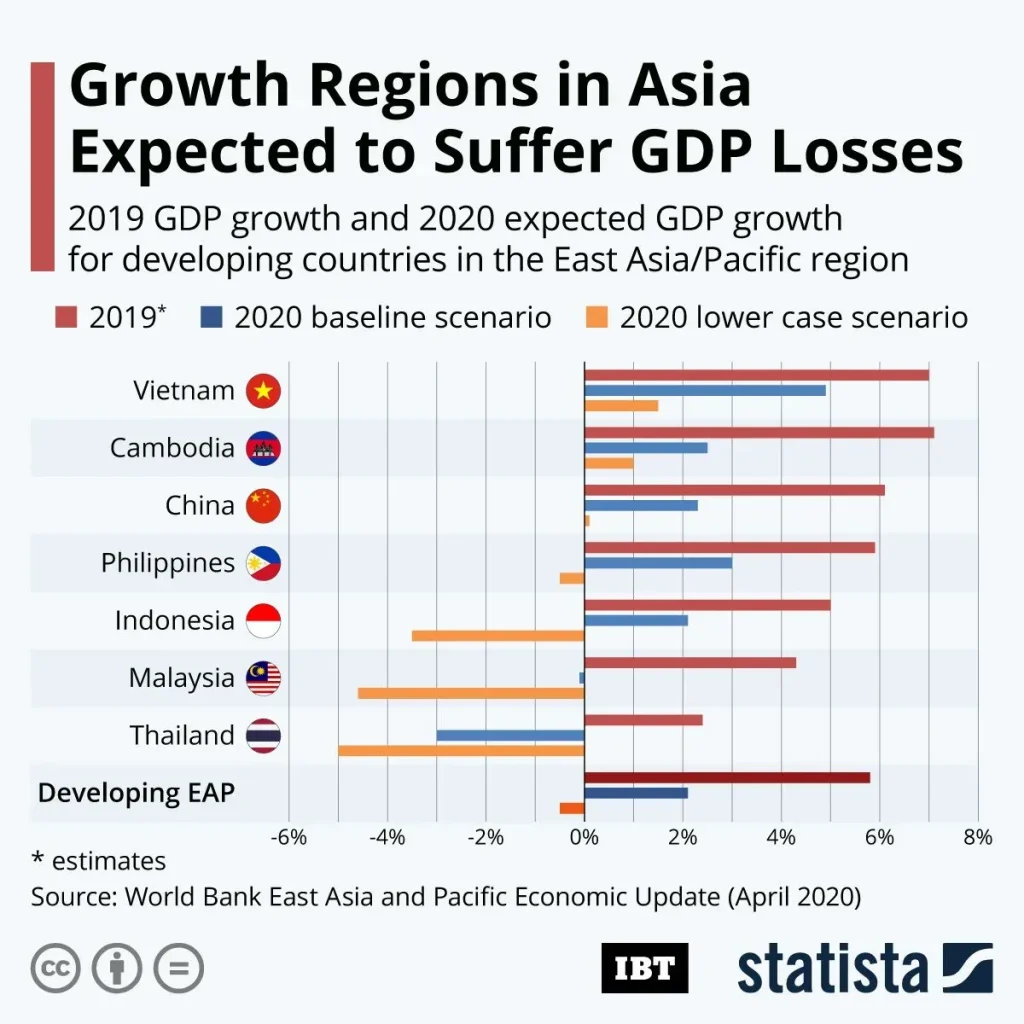

Asia-Pacific growth stands at the heart of today’s global economy, reshaping supply chains, investment inflows, and policy discussions across continents. APAC economic growth is accelerating as digital infrastructure expands, manufacturing capabilities strengthen, and urban middle classes demand better services. This momentum supports broader cross-border commerce, e-commerce platforms, and services across the region, linking farmers and manufacturers with urban consumers and global markets. Policy makers are balancing growth with financial stability, investing in digital skills, logistics infrastructure, and regulatory sandboxes to attract long-horizon capital. For multinational firms and startup ecosystems alike, the takeaway is to build adaptable, region-aware strategies that leverage local talent, connectivity, and openness.

From a semantic perspective, the same trend can be described as a regional expansion across the Asia-Pacific corridor, driven by digital adoption and manufacturing modernization. Viewed as a growth engine for East and Southeast Asia, the region benefits from rising urbanization, a thriving tech scene, and supportive policy environments. Another framing emphasizes the Pacific Rim’s evolving economy entering a productivity and innovation phase that strengthens global linkages. Additional angles highlight the region’s role in resilient value chains, cross-border collaborations, and digital finance rails that connect producers with worldwide buyers. In short, these LSI-informed terms point to a shared core—regional momentum translating into opportunities across technology, trade, and investment.

Asia-Pacific growth and cross-border momentum: Opportunities across APAC markets

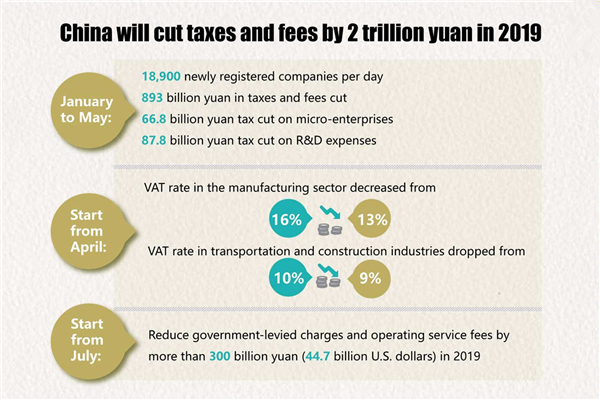

Asia-Pacific growth continues to be a defining force in the global economy, with APAC economic growth driven by a resilient mix of manufacturing upgrades, digital acceleration, and consumer-led demand. This momentum is reshaping investment appetites and policy debates, as venture funding, corporate partnerships, and infrastructure projects channel capital toward digital infrastructure, energy transition, and logistics networks that connect regional hubs with global markets.

The cross-border trade Asia-Pacific dynamic is expanding as e-commerce penetration rises and regional digital rails enable faster, cheaper settlement across borders. Asia-Pacific market trends now reflect a broader shift from traditional manufacturing to service- and data-driven industries, including fintech, health tech, and cloud-based services. This evolution lowers barriers for smaller firms to compete at scale, while attracting global capital seeking durable productivity gains within APAC’s vibrant and increasingly urbanized economies.

EU fintech developments and US market movements: Implications for global finance and Asia-Pacific integration

EU fintech developments continue to set global standards for payments, open banking, and digital identity, influencing Asia-Pacific strategies as firms seek interoperable rails and compliant, scalable solutions. The EU’s emphasis on standardized APIs, strong authentication, and regulatory clarity accelerates cross-border collaboration, creating reliable pathways for non-EU players to participate in European markets while enabling EU fintechs to extend reach into APAC. This alignment supports Asia-Pacific market trends by providing a blueprint for secure, scalable digital finance.

US market movements remain a critical benchmark for risk appetite, capital allocation, and corporate strategy across regions. Shifts in monetary policy, inflation trajectories, and demand cycles in the US profoundly affect currency dynamics and funding costs globally, including in APAC and Europe. For policymakers and business leaders, monitoring US market movements helps anticipate capital flows and investment signals, while EU fintech developments offer the rails to adapt, scale, and compete in a rapidly interconnected financial landscape that spans the Asia-Pacific region.

Frequently Asked Questions

What are the key drivers of Asia-Pacific growth, and how do APAC market trends and cross-border trade Asia-Pacific shape regional investment decisions?

Asia-Pacific growth is driven by a blend of manufacturing rebalancing, digital acceleration, and rising consumer demand. Investments in 5G, fiber, and cloud services boost productivity, while a growing digital economy and expanding regional financial hubs attract capital to tech, fintech, and health-tech startups. APAC market trends show multinationals increasingly viewing the region as an innovation hub rather than just a production base, reinforcing the importance of cross-border trade Asia-Pacific in expanding global reach. In short, Asia-Pacific growth hinges on infrastructure, digital adoption, and policy clarity that together unlock durable, regional-to-global investment opportunities.

How do US market movements and EU fintech developments intersect with Asia-Pacific growth and cross-border trade Asia-Pacific?

US market movements affect currency dynamics, interest rates, and global risk appetite, shaping funding costs and strategic decisions for APAC growth. EU fintech developments—open banking, standardized APIs, and cross-border payments rails—offer scalable tools that facilitate cross-border trade Asia-Pacific and connect European and Asian markets more efficiently. Together, these forces influence capital allocation, product strategy, and partnership models in the Asia-Pacific region. Companies should hedge currency exposure, invest in APAC capabilities, and leverage EU fintech rails to streamline cross-border payments, thereby enhancing resilience and unlocking broader growth across Asia-Pacific.

| Topic | Key Points |

|---|---|

| Asia-Pacific growth drivers and outlook |

|

| EU fintech developments and global reach |

|

| US market movements and global spillover effect |

|

| Cross-border trade, investment, and policy influences |

|

| What this means for businesses and investors |

|

Summary

Asia-Pacific growth stands as a central anchor for regional momentum and global opportunity. The region’s demographic expansion, digital transformation, and manufacturing evolution are reshaping supply chains, consumer markets, and investment strategies across the world. EU fintech developments are accelerating the digitization of finance and creating interoperable rails that connect continents, while US market movements continue to influence risk appetite and capital allocation across regions. By recognizing these interconnected trends—Asia-Pacific growth, EU fintech developments, and US market movements—business leaders and investors can craft strategies that capture growth while managing risk in a rapidly evolving global economy. The future of global business will be defined not by isolated regional performance but by collaboration among Asia-Pacific, Europe, and North America, where technology, trade, and policy converge to shape tomorrow’s opportunities.