Budgeting Made Simple isn’t about denying yourself or turning budgeting into a complex project. If you’re new to money management, Budgeting for beginners can feel daunting, but you can start with a straightforward plan that fits your life. This guide emphasizes simple budgeting methods that save time, reduce guesswork, and help your money work harder for you. You’ll learn how to create a budget quickly using practical templates and automation, so you don’t have to babysit your numbers every day. By focusing on small, repeatable steps and clear milestones, you’ll build confidence and momentum toward your financial goals.

From a broader money-management perspective, the idea is to establish a practical spending plan that aligns with real-life priorities. Think of it as a lightweight framework for allocating income, tracking where it goes, and setting achievable savings targets. This approach emphasizes disciplined habits, accessible tools, and ongoing adjustments to keep your finances resilient. By framing budgeting as a flexible system rather than a rigid rulebook, you can sustain steady progress and adapt to change.

Budgeting Made Simple: A Beginner’s Blueprint for a Personal Finance Plan

Budgeting Made Simple isn’t about restriction; it’s a beginner-friendly approach to a personal finance plan. This method helps you create a budget quickly by using straightforward templates and automation, so you don’t get bogged down in math. For budgeting for beginners, the goal is clarity—define what you’re saving for, outline a realistic monthly spend, and watch your money start working harder for you.

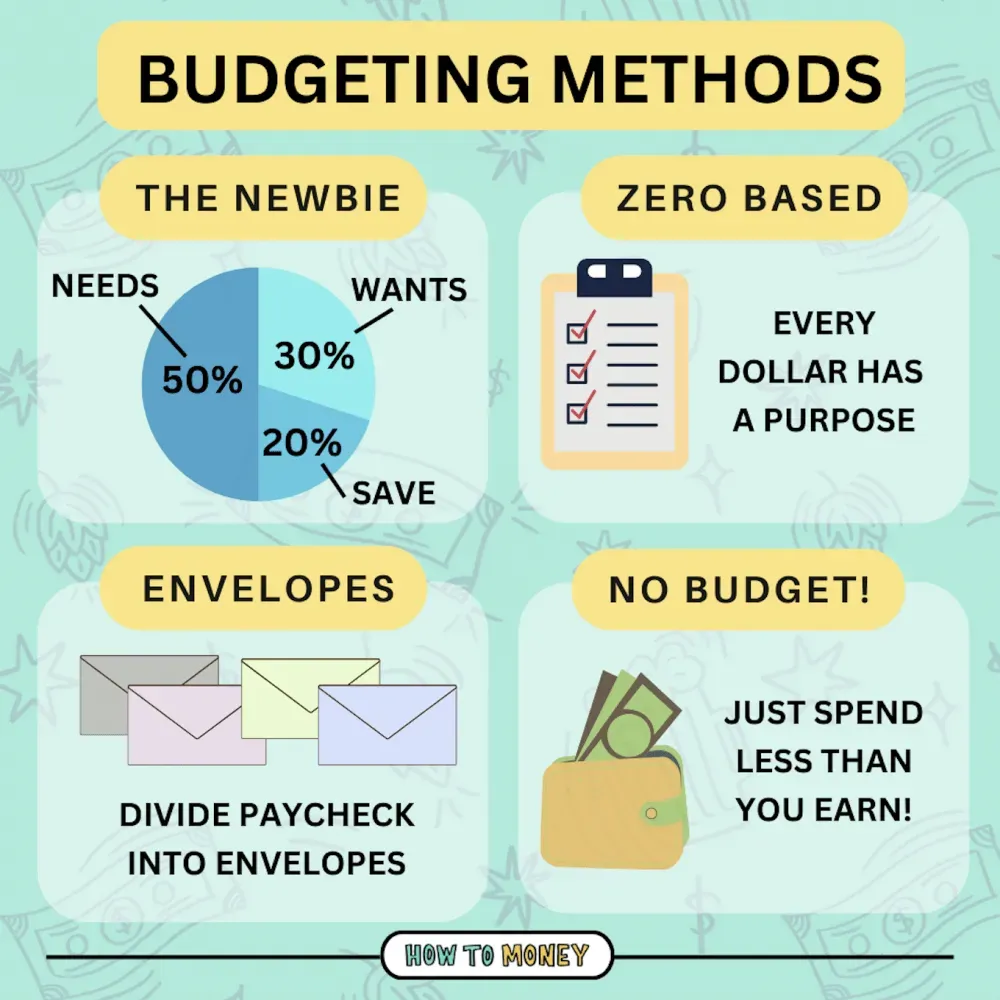

Start by defining your personal finance plan with 3–5 specific goals and tracking income, expenses, and savings for at least 30 days. Choose a simple budgeting method such as the 50/30/20 rule or the envelope method, which keeps the system lean and repeatable. The emphasis is on sustainable progress, not perfection, so you can create a budget quickly and stick with it. Automation—linking accounts and using auto-categorization—helps reduce manual work and keeps you focused on your goals.

Create a Budget Quickly with Simple Budgeting Methods to Track Expenses and Savings

Create a Budget Quickly with Simple Budgeting Methods to help you go from a vague intention to an actionable plan. Using templates and automation, you can assemble a personal finance plan that maps income to needs, wants, and savings in minutes. This approach aligns with budgeting for beginners and leverages simple budgeting methods to keep you moving toward your goals while tracking expenses and savings along the way.

Pair template-driven budgeting with regular check-ins and lightweight monitoring (weekly or biweekly). As you adjust, you’ll see how the budget grows smarter over time and how small changes in spending ripple into bigger savings—exactly the momentum that makes you confident your personal finance plan is delivering results.

Frequently Asked Questions

What is Budgeting Made Simple and how does it help someone starting with budgeting for beginners?

Budgeting Made Simple is a practical framework that helps you build a personal finance plan without overwhelm. It emphasizes simple budgeting methods, templates, and automation so you can create a budget quickly and begin tracking expenses and savings right away. Start by defining 3–5 goals (emergency fund, debt payoff, down payment), then track income and expenses for 30 days to establish a baseline. Choose a method that fits your life—such as the 50/30/20 rule or zero-based budgeting—and use a simple template to organize income, fixed expenses, variable costs, and savings. Automate transfers to savings, auto-categorize transactions, and review progress weekly. The goal is steady progress, clarity, and momentum in your personal finance plan, not perfection.

Which simple budgeting methods should I start with to create a budget quickly under Budgeting Made Simple?

Begin with one or two simple budgeting methods that fit your personality and schedule, such as the 50/30/20 rule or zero-based budgeting, aligned with Budgeting Made Simple. Use a ready-made template to create a budget quickly and set up automation for savings and bill payments so you don’t have to babysit numbers every day. Build your personal finance plan by listing income, fixed essentials, variable needs, and discretionary spending, then set realistic monthly targets for savings or debt payoff. Track expenses and savings weekly to see progress, identify leakages, and adjust categories as life changes. Regular quick reviews keep the plan lean and scalable while keeping you motivated.

| Key Point | Summary | How It helps / Practical Tip |

|---|---|---|

| Core Concept: Budgeting Made Simple philosophy | A lean plan, automated where possible, focused on your goals. Progress happens in minutes, not hours, with sustainable momentum. | Embrace a simple budgeting mindset and automation to stay on track; keep the goals in sight. |

| What you’ll get from this post | A beginner-friendly framework, practical budgeting methods, templates and automation, expense tracking, and ongoing optimization. | Use templates and automation to start quickly and stay consistent. |

| Step 1 – Define your personal finance plan | Set 3–5 specific financial goals for the next 6–12 months; list top priorities (emergency fund, big purchase, debt payoff); write goals down. | Write goals to increase motivation; ensure goals are tangible and time-bound. |

| Step 2 – Track income, expenses, and savings | Capture all income sources and track fixed and variable expenses for at least 30 days to establish a baseline; watch for leakage. | Use a basic expense log or budgeting app; automate data collection to reduce manual work. |

| Step 3 – Choose a simple budgeting method | Pick one straightforward method (50/30/20; zero-based; envelope; pay-yourself-first) and apply consistently. | Starting point: 50/30/20 often balances simplicity and effectiveness; switch if you need tighter control. |

| Step 4 – Create a budget quickly with templates and automation | Use a basic budget template that covers income, fixed essentials, variable needs, discretionary spending, savings/debt goals, and a summary. | Automate categorization, transfers, and alerts to keep the budget current with minimal manual effort. |

| Step 5 – Track expenses and savings to stay on target | Regular check-ins (weekly/biweekly) to compare actuals with plan; ask key questions to stay on track. | Schedule short, recurring reviews to maintain momentum without punitive tracking. |

| Step 6 – Adjust and optimize | Revisit your plan when life changes (raises, new expenses, milestones); adjust targets and reallocations as needed. | Reassess subscriptions, increase automatic transfers after milestones, rebalance categories, set new goals. |

| Common obstacles and how to overcome them | Procrastination, overcomplication, inconsistent income, and relapses into old habits. | Start small, keep it simple, use adaptable plans, and restart with a fresh template if needed. |

| Practical tips for fast results | One-page budget, automated savings/debts, batch budgeting tasks, flexible mindset, and personalization. | Keep it personal and scalable to your life. |

| Real-world examples | Example using 50/30/20: Needs 50%, Wants 30%, Savings/Debt 20% with concrete numbers; adjust by cooking at home to save. | Track gaps between income and expenses and adjust behaviors to close them. |

| Tools and resources | Tools that auto-categorize, set savings goals, generate reports, and sync across devices; low-tech options work too. | Choose tools that fit your routine and keep budgeting visible and consistent. |