Business News 101 is your practical guide to turning fast-paced headlines into actionable insights for investors, executives, and curious readers navigating today’s markets. It breaks down market moves explained into clear signals, helping you separate hype from fundamentals. You’ll learn how to read company reports and translate numbers into a story about performance, prospects, and risk. The course frames investing news analysis as a disciplined process, not a reaction to every headline, using a checklist that highlights financial news decoding and context. In short, the guide culminates in practical skills for earnings reports interpretation, helping you translate numbers into actionable investment judgments.

A companion section reframes the topic using alternative terms such as market dynamics, price action, and corporate disclosures to paint a broader picture. Instead of relying on a single label, the guide maps how headlines influence investor sentiment, sector rotations, and valuation gaps. Readers discover why earnings releases and strategy updates matter, even when immediate moves seem minor, by connecting these signals to macro trends and company fundamentals. This LSI-informed framing helps search engines and readers alike by clustering related concepts like financial storytelling, data interpretation, and risk assessment around the same core idea. Together, both sections reinforce a practical mindset: interpret what you see, verify with sources, and build a clear view of where markets may head next.

Business News 101: Decoding Market Moves and Reading Company Reports

Business News 101 serves as a practical lens to understand how market moves explained unfold in real time. By tracking price action, volume, and breadth alongside macro data, readers learn to distinguish signaling moves from noise. This subtopic emphasizes the core idea of market moves explained as a structured narrative rather than a reaction to a single headline, helping you interpret headlines through the lens of context, trend, and probability.

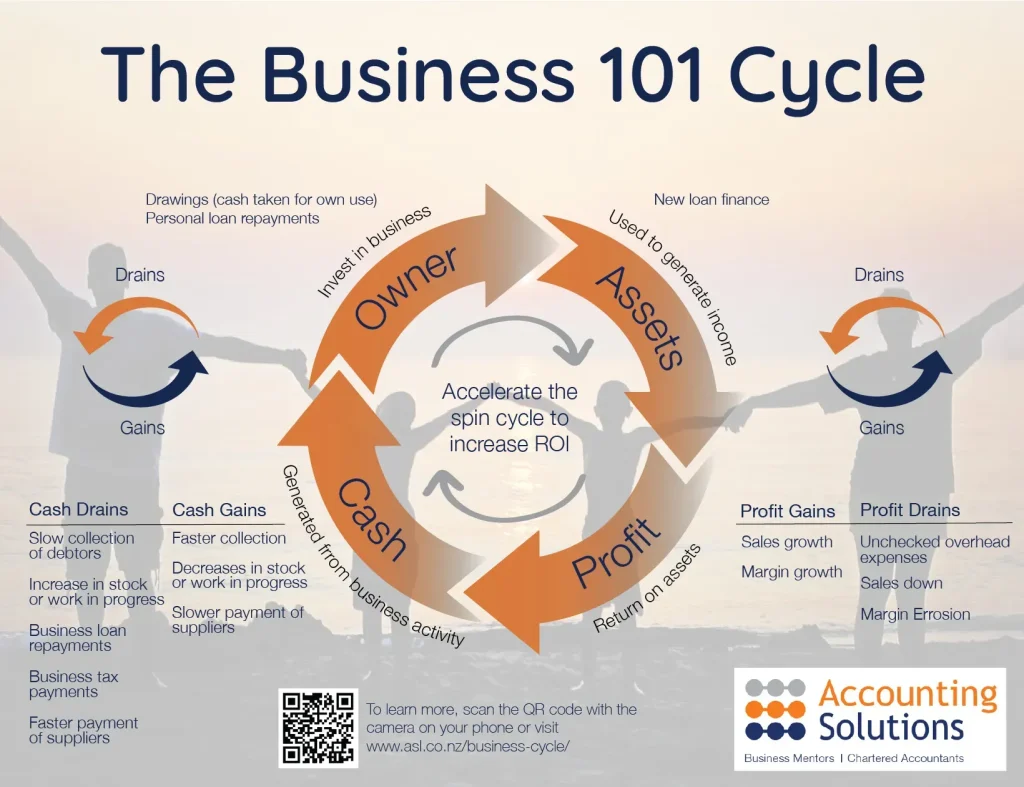

To master how to read company reports, you apply a practical framework that examines the income statement, balance sheet, and cash flow statement in tandem with management guidance. Reading company reports becomes a disciplined exercise in earnings reports interpretation, margin analysis, and capital allocation scrutiny. By incorporating metrics like revenue growth, gross and operating margins, ROIC, and free cash flow, you build a foundation for reliable investing decisions within the broader market environment.

Investing News Analysis: Financial News Decoding and Earnings Interpretation for Better Decisions

Investing news analysis is about weaving together macro signals, sector dynamics, and company-specific results into a coherent story. This approach leverages financial news decoding to translate headlines into actionable insights, using signals such as price action, volume, and market breadth to gauge the durability of a move. By connecting the dots between market psychology and fundamental data, you gain a clearer view of why certain moves occur and how they might unfold.

Earnings reports interpretation becomes a practical exercise in context. Beyond beating or missing Consensus, investors look at guidance, balance sheet strength, and cash flow quality to assess sustainability. This subtopic also highlights the value of cross-checking sources and applying a cautious optimism when management commentary signals potential catalysts or risks. With a disciplined routine for evaluating earnings, you’ll enhance your ability to perform investing news analysis and to differentiate impactful signals from transient noise.

Frequently Asked Questions

What is Business News 101, and how does it help with market moves explained and reading company reports?

Business News 101 is a practical framework for decoding market moves explained and interpreting earnings and company reports. It teaches you to separate noise from signal by analyzing key indicators such as price action, volume, breadth, macro data, and sector rotation, while providing a clear approach to how to read company reports (income statement, balance sheet, cash flow) and to investing news analysis and financial news decoding.

How can I use Business News 101 for investing news analysis and earnings reports interpretation when decoding market moves?

Use Business News 101 to structure investing news analysis: monitor earnings calendars, review filings and press releases, and compare results to consensus to sharpen earnings reports interpretation. Relate company results to macro conditions and sector trends to assess whether a move is idiosyncratic or part of a broader shift, applying the market moves explained framework to everyday headlines.

| Topic | Key Points | Practical Takeaways |

|---|---|---|

| Market Moves Explained | Market moves are driven by macro factors, sector rotations, company fundamentals, and investor psychology; some moves are noise, others signals. | Differentiate noise from signal and quantify implications for future performance. |

| Signals to Watch | Key signals include price action/momentum, volume, breadth, macro data, and sector rotation. | Use these signals to assemble a coherent story rather than reacting to a single data point. |

| Reading Company Reports | Income statement, balance sheet, cash flow, margins/ROIC, guidance, footnotes/risks, management narrative. | Focus on actual performance, strategic clarity, and future outlook; seek reconciliations for non-GAAP figures. |

| Holistic View & Process | Connect macro conditions, industry dynamics, and company results; follow a simple, repeatable process. | Follow a five-step workflow: scan headline, check price action/volume, read earnings materials, compare to prior/consensus, map to macro/sector trends. |

| Practical Steps for Beginners | Dashboards, reading routine, micro-analysis of one company per week, and tracking key metrics. | Build a routine, practice with real reports, document findings, and gradually expand tools. |

| Ethical & Practical Considerations | Respect market complexity; avoid overrelying on headlines; cross-check sources; diversify inputs. | Maintain a balanced information diet and quantify moves while noting potential biases. |

| Case Study | Hypothetical software company with better-than-expected results, raised guidance, but later concerns emerge. | Illustrates linking market signals to fundamentals and the need for follow-through on execution. |

| Tools & Resources | Earnings calendars, SEC filings, press releases, financial news outlets, screeners, transcripts. | Build reliable tooling for timely insights and multiple perspectives. |

| Common Pitfalls to Avoid | Overreacting to headlines, ignoring guidance, neglecting macro context, relying on a single source. | Diversify inputs and quantify surprises; always cross-check with broader context. |