Finance and Markets shape every decision traders make as global sessions begin and price discovery unfolds across stocks, bonds, currencies, and commodities. For traders, keeping a finger on essential business news isn’t a luxury—it’s a core skill that underpins risk control, position sizing, and the timing of entries and exits. In practice, Stock market news for traders surfaces through price moves, intraday breadth, and earnings surprises, offering clues about momentum and potential reversals. This landscape spans macro data releases, central bank commentary, policy shifts, geopolitical developments, and corporate guidance—every data point interacting to shape asset correlations and volatility. The goal of this guide is to help you discern what counts as essential news, how to consume it efficiently, and how to translate insights into disciplined trading setups.

Viewed through the lens of Latent Semantic Indexing, the topic can be framed as capital markets intelligence, macro-driven market color, and price-action narratives rather than isolated headlines. For example, rather than chasing every headline, you can monitor Economic indicators for traders such as GDP, inflation, unemployment, and consumer confidence to gauge momentum and policy risk. These terms map to capital markets intelligence, macro-driven narratives, and cross-asset signals, reinforcing the same underlying dynamics that move shares, bonds, currencies, and commodities. By combining this LS-informed framing with a disciplined routine, you can build a workflow that translates news into specific plans—entry ideas, risk controls, and evaluation criteria for ongoing learning. The LS approach also helps you connect macro updates with micro-price action, so you can see how a central bank statement might ripple through futures curves or currency pairs. In practice, this means labeling data with intent—noting whether news shifts momentum, risk premia, or correlations—so your responses are consistent rather than reactionary. Ultimately, adopting an LS-consistent viewpoint supports a sustainable learning loop that evolves with markets, enabling you to refine routines, calibrate expectations, and improve decision quality over time. Consider building a glossary of LS-aligned terms and linking them to your chart setups, so your team moves in sync when headlines hit. As you practice, you’ll begin to recognize patterns where similar news drives different assets, empowering you to adapt strategies across equities, fixed income, foreign exchange, and commodities. Benchmark the approach by tracking how often news triggers trades and how often those trades meet your risk-reward criteria, adjusting variables as you learn. Regular reviews should quantify signal quality, execution efficiency, and the alignment between your expectations and realized outcomes in different market regimes. Over time, this iterative LS-informed process becomes a strategic edge, helping you discriminate noise from meaningful shifts and stay resilient when headlines move markets in unexpected directions. Finally, cultivate a habit of curiosity, comparing outcomes across timeframes and instruments to deepen intuition and preserve adaptability in evolving markets.

Finance and Markets: Essential News for Traders

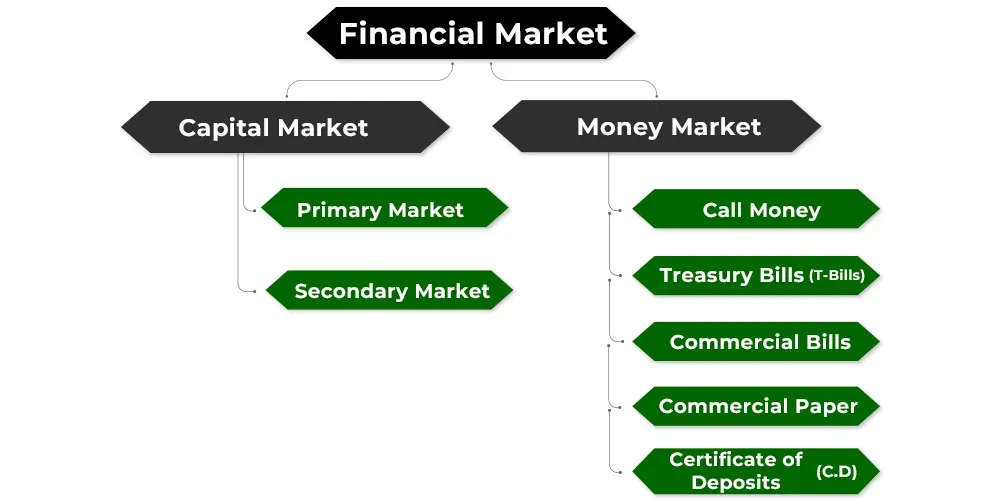

Finance and Markets drive every decision in trading. For traders, essential news includes real-time price action, macro data releases (GDP, inflation, unemployment), central bank commentary, earnings, geopolitical events, and policy shifts that ripple through asset prices. This coverage—encompassing stock price moves, sentiment, and volatility—helps traders gauge probable paths and risk levels. In practice, framing the news around stock market news for traders and trading news and market updates provides a pragmatic lens for immediate opportunities and risk controls.

How to consume information efficiently: use a trusted calendar, prioritize sources that synthesize data into actionable insights, and map news to a trading plan. The goal is to blend Financial market analysis for traders with macro awareness to anticipate cross-asset moves, manage risk, and seize favorable conditions. Keeping an eye on Global finance news for traders helps ensure your view isn’t siloed by region.

Economic Indicators and Global Finance News for Traders: Using Cross-Border Signals

Economic indicators for traders are the backbone of many intraday and swing strategies. GDP growth, inflation (CPI/PPI), unemployment, consumer confidence, manufacturing PMIs, and retail sales inform expectations for policy and risk appetite. Traders interpret these indicators to determine momentum, inflation pressures, and cooling activity, adjusting exposure across stocks, bonds, currencies, and commodities. This is where stock market news for traders often intersects with economic data releases to shape intraday volatility and longer-term bias.

Global finance news for traders ties domestic data to international dynamics. Cross-border events—differing central bank stances, global demand shifts, geopolitical developments, and trade policy—reshape correlations and create hedging challenges or diversification opportunities. By integrating global finance news for traders with local indicators, traders can spot turning points, manage cross-asset risk, and align positions with macro themes. This approach also complements Financial market analysis for traders and trading news and market updates to stay ahead.

Frequently Asked Questions

How can stock market news for traders improve intraday strategy and risk management?

Stock market news for traders provides real-time context for price action and volatility around earnings, macro surprises, and policy shifts. Use a trusted news calendar, observe how headlines influence intraday moves, and confirm signals with technical setups and breadth. Translate the news into a simple plan: defined entry, stop loss, position sizing, and a clear exit rule to manage risk.

How does financial market analysis for traders use economic indicators for traders alongside global finance news for traders to manage cross-market risk?

Financial market analysis for traders blends economic indicators for traders with global finance news for traders to map cross-border risk and asset correlations. Track GDP growth, inflation, unemployment, PMIs, and consumer sentiment, compare results to expectations, and weigh central bank guidance. Consider how surprises affect currencies, bonds, equities, and commodities, and adjust positions with scenario planning and disciplined risk controls.

| Topic | Core Points | Notes / Examples |

|---|---|---|

| Essential Finance and Markets News | – Real-time or near-real-time price action, macro data releases, central bank communications, monetary and fiscal policy developments, earnings, and geopolitical events. – These items influence asset prices and risk, helping traders anticipate volatility and adapt positions. – Focus on information that moves prices or alters risk rather than chasing every item. |

|

| Stock Market News | – Price action, momentum, and volatility in response to earnings, guidance, and macro surprises. – Intraday moves, volume, and liquidity clues for momentum and potential reversals. – A single headline can trigger rapid swings; combine with breadth and sector rotation for a fuller picture. |

|

| Financial Market Analysis | – Blends technical analysis (charts, support/resistance, trend lines) with fundamental underpinnings (earnings trends, macro indicators, policy signals). – Forms a probabilistic view of future moves and helps answer: genuine breakout or bear trap? Is risk premium aligned with macro backdrop? How do cross-asset correlations shift after data releases? |

|

| Trading News and Market Updates | – Timely and relevant updates are most valuable when sourced from trusted calendars and high-quality outlets. – Translate updates into a practical plan: entry, exit, risk controls, and position sizing. |

|

| Economic Indicators | – GDP growth, inflation (CPI/PPI), unemployment, consumer confidence, PMIs, and retail sales. – Indicators signal momentum, inflation pressures, or cooling activity and influence policy expectations and risk appetite. – Interpret interactions across assets (stocks, bonds, currencies, commodities) to adjust exposure. |

|

| Global Finance News | – Cross-border effects and capital flows shape market correlations: currency reactions, commodity prices, and bond pricing. – Geopolitics, trade policy, and synchronized central-bank moves can alter asset relationships and diversification needs. |

|

| Interpreting News in Context (Framework) | – Assess source reliability (official releases, central banks, reputable outlets). – Consider expected vs. surprise components and their market impact. – Gauge market reaction/volatility (implied volatility, options activity, liquidity). – Map news to a trading plan (trade immediate move, fade noise, or adjust risk controls). – Use risk management as a constant (stop losses, position sizes, diversification). |

|

| Strategic Approaches | – News-based scalping and short-term swings with defined risk and tight stops. – Trend-following with macro bias aligned to persistent indicators and policy signals. – Event-driven positioning around earnings or policy speeches. – Hedging and risk-off strategies to protect capital during periods of uncertainty. |

|

| Practical Sources & Tools | – Economic calendars and central bank communications. – Reputable financial news outlets that provide concise summaries and context. – Market data platforms with charting, breadth indicators, and inter-asset correlations. – Earnings trackers and guidance databases to assess company-specific impacts. |

|

| Implementation (Routine) | – Pre-market review: skim major headlines, key releases, and notable earnings. – Data digest: summarize likely market reaction and identify trade setups. – Trade planning: draft a lightweight plan with risk parameters (stops, targets). – Post-market review: assess what worked and refine approach. |

|

| Common Pitfalls | – Overtrading on headlines; not every item warrants a trade. – News bias and confirmation bias; verify signals with multiple indicators. – Ignoring risk controls during high volatility; maintain disciplined sizing and protective stops. |

Summary

Finance and Markets shape every trading decision by transmitting price moves, macro data, central bank signals, and policy shifts. By understanding what constitutes essential business news for traders—and applying a disciplined framework to interpret and act on this information—you can navigate volatility and improve decision-making. With a routine built on reliable sources, risk controls, and continuous learning, traders are better positioned to translate news into consistent performance over time.