Future of Finance 2025 is reshaping how people and businesses think about money, blending advanced technology with everyday financial decisions and redefining what it means to manage resources with confidence. The finance trends 2025 are guiding decisions as AI helps automate tasks, tailor advice, and strengthen risk controls, enabling individuals to optimize budgets, plan for retirement, and respond quickly to shifting markets. Digital payments are moving from a convenient option to a fundamental layer of financial identity, powering instant transfers, spending insights, and seamless cross-border commerce across smartphones, wearables, and connected home devices. Open banking, enhanced data portability, and smarter risk models are expanding access to services while demanding higher standards of security, privacy, and interoperability across banks, platforms, and fintech providers. Staying informed about these shifts helps you protect resources, seize opportunities, and navigate the evolving, highly connected landscape with greater clarity.

Beyond terminology, the story reads as a broader shift toward a data-driven, platform-enabled financial system where software orchestrates interactions between customers, providers, and capital. In this alternative framing, AI in finance converges with open ecosystems, empowering automated advisory tools, personalized offers, and faster onboarding. The rise of digital payments 2025 is shaping shopper experiences and corporate settlement rails, while fintech innovations 2025 unlock new combinations of services through APIs, embedded finance, and modular product stacks. Regulatory frameworks, including crypto regulation 2025, are carving out a safe space for digital assets, ensuring consumer protection and defined governance without stifling innovation. As these terms converge, the underlying message remains the same: adopt trusted solutions, prioritize security, and stay adaptable in a landscape that rewards clarity, resilience, and ongoing learning.

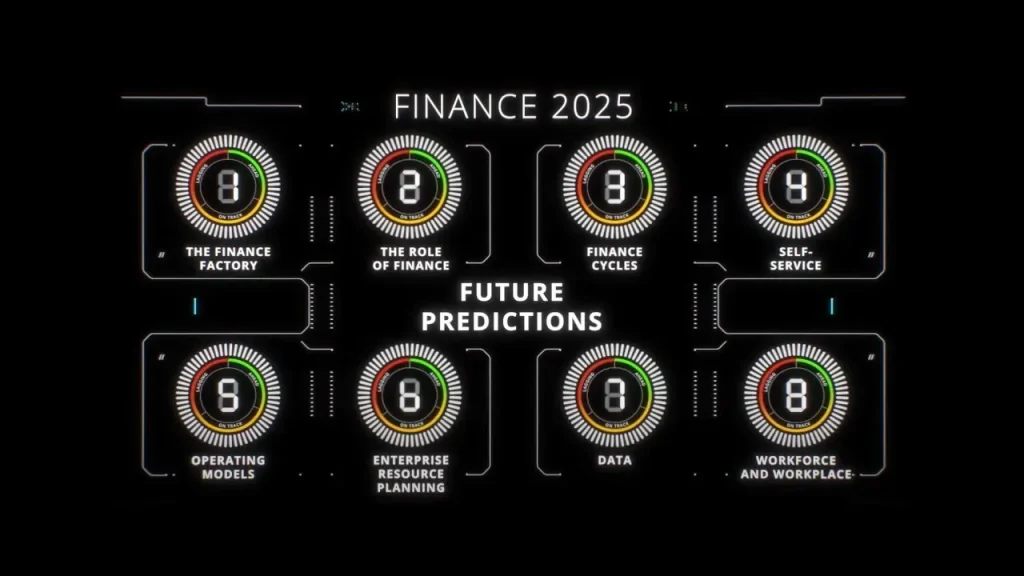

Future of Finance 2025: AI, Digital Payments, and Fintech Innovations Reshaping Everyday Money

The Future of Finance 2025 marks a shift from isolated apps to an integrated financial ecosystem where AI in finance drives smarter decisions, digital payments 2025 enable instant transactions, and fintech innovations 2025 streamline how money moves through everyday life. This convergence creates more personalized budgeting, faster loan approvals, and better forecasting for savings goals, aligning with broader finance trends 2025 that prioritize automation, data-driven insights, and broader access to services.

As wallets become dynamic hubs, consumers gain real-time expense tracking, automated savings, and even micro-investing within a single interface. Open banking expands data access and product delivery, while embedded finance options allow services to bundle payments, insurance, and lending directly into non-financial apps. The outcome is a more seamless, efficient financial experience that mirrors the finance trends 2025 arc toward smarter risk assessment and user-centric design.

Navigating Crypto Regulation 2025 and Trust in Digital Wallets

Crypto regulation 2025 continues to mature, providing clearer guardrails for digital assets while preserving space for responsible innovation. Regulators aim to protect consumers, reduce systemic risk, and establish transparent paths for tokenized assets, cross-border payments, and crypto-based services to scale within a well-governed framework. This balance helps translate the potential of crypto regulation 2025 into practical benefits for everyday finance and institutional use.

Meanwhile, security, privacy, and trust remain foundational as wallets grow more capable. Clear data rights, robust authentication, and proactive disclosure about data usage help users feel secure while embracing crypto-enabled conveniences. By aligning with crypto regulation 2025 and embracing best practices in AI in finance and digital payments 2025, providers can foster confidence, accelerate adoption, and deliver safer experiences across fintech innovations 2025.

Frequently Asked Questions

What role does AI in finance play in the Future of Finance 2025 for personal budgeting and lending?

In the Future of Finance 2025, AI in finance is mainstream across money management. It powers automated budgeting, smarter credit scoring, fraud detection, and faster loan approvals, delivering personalized financial planning and improved risk assessment. For consumers, this means more accurate lending decisions, quicker access to capital, and tailored savings goals; for lenders and fintechs, AI analytics enable better terms, lower losses, and more efficient operations.

How will digital payments 2025 and fintech innovations 2025 reshape wallets and consumer choices under the Future of Finance 2025?

Digital payments 2025 have made payments the default, turning wallets into dynamic financial hubs that integrate expense tracking, budgeting, loyalty programs, and micro-investing. Fintech innovations 2025—embedded finance, API marketplaces, and modular products—let apps offer lending, insurance, or savings tools directly, improving onboarding, pricing, and transparency. The result is smoother, more capable wallets and easier access to financial services, with security and privacy remaining essential.

| Aspect | Key Points |

|---|---|

| Driving forces | AI enhances decision making; digital payments default; open banking expands data access; fintech innovations reshape service delivery; greater automation, smarter risk assessment, broader access, and new governance balancing convenience with security. |

| AI in Finance (Main Trend) | AI enables credit scoring, fraud detection, customer service, and personalized financial planning; translates to better lending decisions, faster approvals, and deeper investor analytics. |

| Digital Payments & Wallets (Main Trend) | Wallets become interfaces for loyalty, subscriptions, real-time budgeting; QR codes, contactless transfers, and instant settlement are common; future wallets integrate expense tracking, automated savings, and micro investing. |

| Fintech Innovations 2025 (Main Trend) | Embedded finance, API marketplaces, modular products allow services to be plugged into nonfinancial platforms; faster onboarding, competitive pricing, and transparent options; open APIs and platform ecosystems grow. |

| Crypto Regulation 2025 & Responsible Innovation (Main Trend) | Maturing regulation protects consumers and reduces systemic risk while enabling legitimate innovation; balanced rules support tokenized assets and cross-border payments with security. |

| Security, Privacy, and Trust | Stronger cybersecurity, privacy protections, and user empowerment; MFA, device management, data rights, and transparent disclosures; trusted institutions attract users seeking convenience with safety. |

| What This Means for You & Your Wallet | Personal finance becomes proactive with automation and better access; stay informed on regulations and AI/fintech impacts; actions include AI-assisted budgeting, thoughtful digital wallets, crypto regulation monitoring, embedded finance exploration, and prioritizing security. |

| Potential Challenges & Considerations | Regulatory clarity, interoperability, and information overload; cultivate digital literacy and ongoing financial literacy as products evolve and small differences in terms/fees compound. |

Summary

The table above summarizes the key points from the base content to highlight how the Future of Finance 2025 is shaped by driving forces, major trends, practical implications for individuals, and potential challenges.