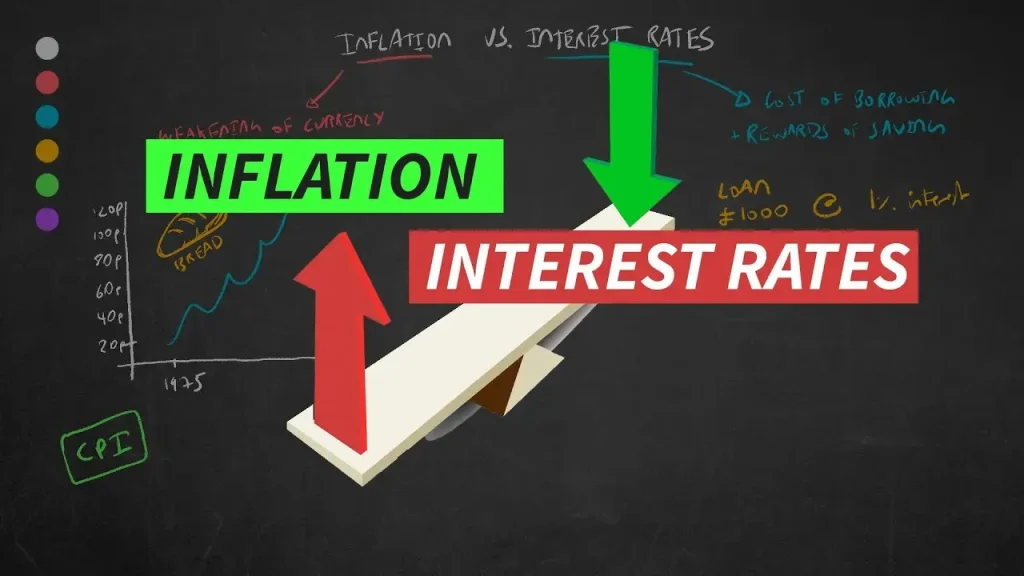

Inflation and Interest Rates are reshaping the business landscape in real time, forcing executives to act with clarity and speed. To thrive under these conditions, leaders are creating a new corporate playbook that links pricing, margins, and capital decisions. They must monitor currency moves, policy signals, and central bank rate decisions, translating signals into guardrails for investment and budgeting. In this environment, cost structures, working capital, and risk appetite shift as inflation feeds into wages and supplier terms. The result is a more deliberate, disciplined approach that blends scenario planning with rapid execution to protect margins and sustain growth.

Beyond the textbook terminology, these forces resemble a price-pressure cycle and a shifting policy path that businesses must navigate. Strategic framing now relies on a broader set of terms such as monetary policy moves, the trajectory of borrowing costs, and the evolving cost of capital. By mapping demand signals, supplier dynamics, and currency exposure to these semantic cousins, leaders can build buffers and scenarios that resonate with frontline decisions. This LSI-informed framing helps align content with related concepts that search engines associate with inflation, rates, and corporate resilience.

Inflation and Interest Rates: How Central Bank Rate Decisions Shape Your Business Strategy in Rising Rates

Inflation and Interest Rates are shaping business outcomes in real time, so executives can’t wait for quarterly earnings to adjust. With inflation persisting in many economies, input costs, wages, and logistics remain elevated, while policy expectations influence discount rates, capital budgets, and investment timing. Understanding the impact of inflation on businesses is essential for pricing, profitability, and working capital management. This reality calls for a new corporate playbook—a structured approach to anticipate pressure points and execute with discipline rather than react to sound bites.

Central bank rate decisions set the cost of capital and signal the trajectory of financing for growth. That makes business strategy in rising rates a deliberate discipline: link pricing to customer value, hedge key exposures, and reallocate capital toward durable margins. Because policy signals often move markets before formal announcements, robust scenario planning and governance are more important than ever to protect earnings and cash flow.

Implementing the New Corporate Playbook: Pricing, Working Capital, and Digital Transformation for Resilient Growth

Implementing the new corporate playbook starts with pricing discipline, cost efficiency, and working capital optimization across functions. Techniques such as value-based pricing, dynamic discounting, and tighter inventory turns help preserve margins when inflation squeezes profitability and currency effects add complexity.

The playbook also calls for proactive debt management, hedging, and selective capital allocation to thrive in a higher-rate world. By pairing digital transformation with real-time margin analytics, firms gain visibility to pricing, supplier terms, and capex decisions, enabling faster, more informed bets on growth while safeguarding liquidity.

Frequently Asked Questions

How can a company build a new corporate playbook to navigate Inflation and Interest Rates, including strategies around pricing, working capital, and capital allocation?

Create a concise, scenario-driven playbook that treats Inflation and Interest Rates as core inputs. Key steps: • Pricing and margins — adopt value-based and dynamic pricing to protect profitability amid rising input costs. • Working capital and liquidity — optimize inventory turns, accelerate collections, and secure favorable supplier terms to reduce financing needs. • Debt and capital structure — maintain flexible credit facilities, consider hedging interest-rate exposure, and align maturities with cash flow. • Risk governance and digital enablement — establish clear ownership, regular stress tests, and real-time margin analytics. By tying these elements to multiple inflation paths and central bank rate decisions, the company preserves growth potential even in a volatile rate environment.

What is the impact of inflation on businesses and how should organizations respond to central bank rate decisions and a rising-rate environment in their business strategy?

Inflation raises input costs and can squeeze margins, while rising rates increase the cost of capital. To respond, align business strategy with central bank rate decisions and implement: • Pricing discipline — adjust price-to-value messaging, use tiered offerings, and dynamic promotions to protect margins. • Cost discipline and productivity — pursue targeted cost reductions and smart automation to improve efficiency. • Working capital and capital allocation — tighten receivables, optimize inventory, and prioritize durable, scalable investments; consider debt reduction when cash flow allows. • Hedging and risk management — deploy hedges for interest rates, commodities, and currencies, backed by governance and regular stress testing. • Communication cadence — maintain clear leadership updates to preserve stakeholder confidence during rate fluctuations.

| Key Point | Details |

|---|---|

| Inflation and Interest Rates shape outcomes | They influence costs, pricing power, and investment opportunities in real time. |

| Signals executives watch | Central bank press releases and quarterly earnings reports signal tomorrow’s costs and opportunities. |

| Persistent inflation and rate swings | Require rethinking capital allocation, working capital management, and margin protection. |

| A shifting baseline | Not a one-off phenomenon; demands a deliberate, disciplined response. |

| New corporate playbook | Move beyond traditional playbooks to anticipate inflation pressure points, leverage rate movements, and align strategy with resilient execution. |

| Purpose of the article | Explain how Inflation and Interest Rates redefine corporate strategy and outline a practical approach to adopting a modern playbook for growth in uncertain macro conditions. |

Summary

Conclusion: Inflation and Interest Rates are reshaping how businesses invest, price, and operate. The new corporate playbook emphasizes disciplined pricing, cost discipline, working capital optimization, risk management, and digital enablement to navigate higher costs and rate volatility. By aligning strategy with resilient execution and cross-functional collaboration, companies can protect margins, sustain cash flow, and capture opportunities as inflation persists and rate movements create new competitive dynamics. In essence, the trajectory of Inflation and Interest Rates will continue to influence capital allocation, pricing power, and growth trajectories, making scenario-based planning and agile decision making essential for durable success.