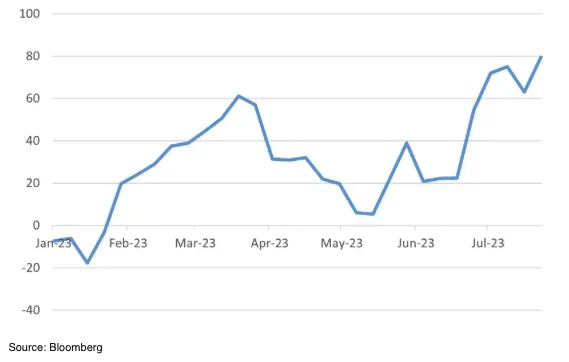

July economic surprises sent ripples through the financial landscape, prompting economists to reevaluate their expectations for the Australian economy. Among the most unexpected developments was the Reserve Bank of Australia (RBA)’s decision to maintain interest rates, counter to widespread predictions for a cut. Meanwhile, a sudden uptick in unemployment, climbing from 4.1% to 4.3%, raised urgent questions about the sustainability of recent labor market stability. Coupled with trade tariff impacts from the US that were higher than anticipated, these economic shifts have created a more complex business outlook in Australia. As we delve deeper, it becomes clear that these July surprises are not just anomalies; they reveal underlying trends that could shape economic policy and business strategies for months to come.

The unexpected economic events of July caught many by surprise and have significant implications for future financial stability in the region. The decision by the Australian central bank to hold interest rates was a notable deviation from forecasts, buoyed further by a sudden rise in unemployment that many analysts had not predicted. Additionally, the impact of rising tariffs from international trade agreements has raised concerns about the trajectory of business growth in Australia. These developments compel a reassessment of the current economic climate and business conditions, underscoring the interconnectivity of global markets and local economies. As we analyze the consequences of these surprises, it’s essential to focus on how they influence the broader economic narrative and potential recovery paths for Australian enterprises.

Economic Surprises in July: A Shift in the Australian Landscape

July brought unexpected economic surprises that reshaped the landscape for Australia’s economy, compelling market analysts and policymakers alike to reevaluate their predictions. Notable among these was the decision by the Reserve Bank of Australia (RBA) to hold interest rates steady, contrary to widespread expectations for a cut. This surprising move came after months of speculation and was deeply intertwined with rising inflation data that began to emerge. The RBA’s caution reflects broader economic challenges and highlights that while short-term metrics might look favorable, underlying inflationary pressures could indeed signal trouble ahead for the Australian economy.

Moreover, these shifts occurred against the backdrop of concerns surrounding unemployment trends, which also took an unexpected upward turn in July. With the unemployment rate climbing from 4.1% to 4.3%, economists found themselves scrambling to reassess not only labor market health but also consumer confidence. The interplay between the RBA’s monetary policy and the labor market’s directional changes will be pivotal as Australia navigates through these upcoming months of economic uncertainty.

Frequently Asked Questions

What were the significant economic surprises related to July’s Australian economy?

In July, three significant economic surprises affected the Australian economy: the RBA’s unexpected decision to hold interest rates steady, a jump in the unemployment rate from 4.1% to 4.3%, and the finalization of high US tariff rates exceeding predictions. Each of these developments shifted forecasts for the economic outlook in Australia.

How did the RBA’s decision impact July’s economic outlook?

The RBA’s decision to maintain interest rates in July surprised economists, who anticipated a cut. This move indicated caution amid rising inflation, aligning with recent economic data. The board’s deliberation underscores the complexity of the Australian economy, particularly as businesses assess the implications of this steady stance amidst changing market conditions.

Why did unemployment rates rise unexpectedly in July?

The Australian unemployment rate unexpectedly rose from 4.1% to 4.3% in July, breaking a trend of stability. Analysts did not forecast such a spike, which was influenced by broader economic pressures and a tightening labor market. This change prompted deeper consideration of future RBA policy directions, given the conflicting indicators emerging from the business landscape.

What are the implications of US tariff rates on Australia’s economy?

The finalization of US trade agreements resulted in tariff rates of 15-20%, which exceeded economist predictions. These tariffs can adversely affect Australian exports and supply chains, leading to heightened production costs and potentially contributing to slower economic growth both in the US and globally, with downstream effects likely on the Australian economy.

How do these economic surprises affect business outlook in Australia?

The unexpected economic surprises in July—particularly concerning interest rates, unemployment, and trade tariffs—have created a more challenging business outlook in Australia. Companies face heightened instability as they navigate these changes, and many must prepare for increased risks, including potential business failures due to evolving global economic pressures.

What measures are being taken to stabilize the Australian economy amid these surprises?

To stabilize the economy, the Australian government has implemented income tax cuts and continued cost-of-living support. These measures have helped keep business failure rates from escalating beyond elevated levels, despite ongoing economic uncertainties and the impacts of the surprises from July.

What does the stabilization of insolvency rates indicate for Australian businesses?

The stabilization of insolvency rates suggests a temporary breathing room for Australian businesses following the tax cuts and support measures. However, it is essential to recognize that this plateau does not imply a fundamental improvement in the business climate, as ongoing economic pressures remain.

How can businesses prepare for the challenges posed by July’s economic surprises?

Businesses should focus on strengthening their financial positions by optimizing costs, enhancing operational efficiencies, and preparing contingency plans to navigate the uncertainty stemming from July’s economic surprises. Being proactive in addressing these challenges will be critical as the economic landscape evolves in the coming months.

| Economic Surprise | Description | Implications |

|---|---|---|

| RBA Rate Hold | The RBA decided to maintain interest rates in July, surprising analysts who expected a cut. | Indicates caution regarding inflation, affects forecasts for interest rates in August. |

| Unemployment Increase | Unemployment rose from 4.1% to 4.3%, contrasting previous stability in the labor market. | Signals potential weaknesses in the labor market, complicating economic outlook. |

| US Tariff Finalization | Finalized trade deals resulted in higher tariff rates on imports from the EU and Japan than expected. | Increased costs for goods, may lead to slower economic growth and impact Australian exports. |

Summary

July economic surprises caught analysts and policymakers off guard, leading to adjustments in forecasts and expectations. The unexpected RBA decision to hold interest rates steady, the abrupt rise in unemployment, and the finalization of higher-than-anticipated tariffs suggest a complex economic landscape for Australia. Businesses may experience short-term relief due to government support, but ongoing global pressures and inflation risks could lead to a challenging environment ahead. Thus, staying prepared for potential business volatility over the next few months is essential.