Crafting a personal finance plan that works isn’t about luck; it’s about building a repeatable system you can actually follow day after day, month after month, that turns vague intentions into concrete routines, checks and reminders, and a default posture of mindful, purposeful money management, so you can revisit it weekly and adjust as life unfolds. When you align your money with clear priorities, you move beyond overwhelm and turn big ambitions into practical, measurable steps, including guidance on how to create a personal finance plan and ideas for cultivating mindful spending along the way, plus a simple cadence for reviewing progress. This approach blends smart budgeting with practical milestones, helping you start with an emergency fund, map a debt payoff plan, and define financial goals that feel both ambitious and doable, while keeping room for life changes and small, steady wins that compound over time. With a personal budget plan that reflects your values, you can track income and expenses, identify leaks, set realistic targets, and reallocate funds without sacrificing essential security or future opportunities, integrating regular checks and optional tweaks to stay aligned with shifting needs. Whether you’re paying down debt, saving for future needs, or planning a major purchase, the framework here gives you momentum, accountability, and a path from intention to real results that grows stronger with practice, patience, and consistent action.

In plain terms, this money-management blueprint focuses on steady saving, clear milestones, and flexible adjustments that fit real life rather than rigid rules. Think of it as a systematic spending plan that grows your net worth over time, pairing regular contributions with debt reduction tactics and resilient buffers against surprises. By framing money decisions around genuine priorities and credible targets, you create a sustainable rhythm that travels with you through life’s changes and builds confidence year after year.

How to Create a personal finance plan that works

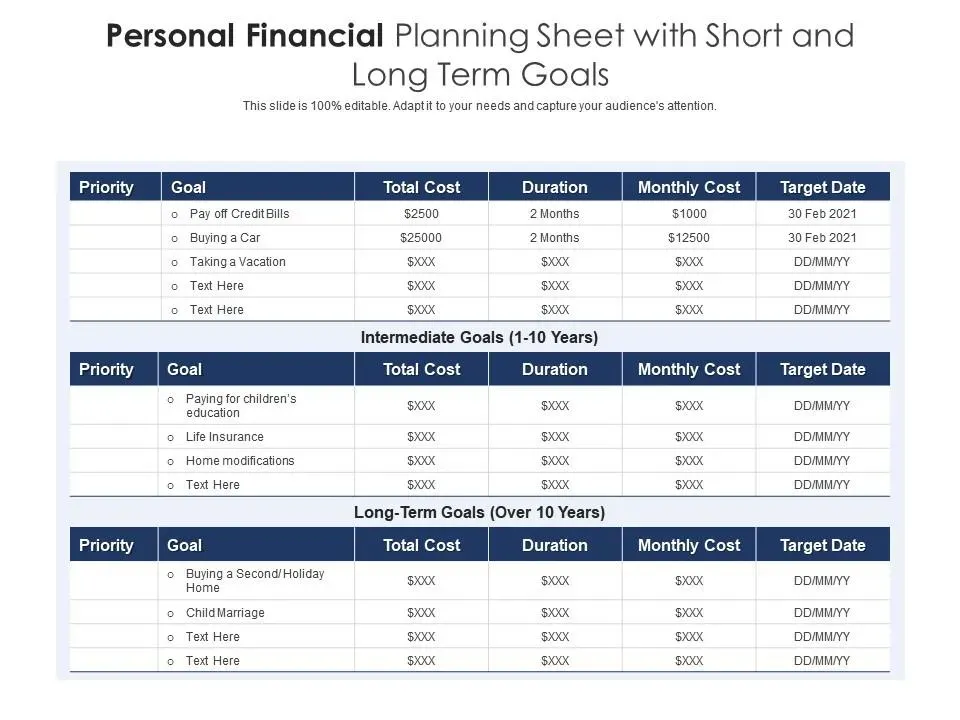

If you’re wondering how to create a personal finance plan, start with clarity about your financial goals. A personal finance plan that works begins by defining concrete targets—short-term, medium-term, and long-term—and attaching numbers to them. For example, saving $5,000 in an emergency fund by year’s end or paying off a specific debt within a set timeframe creates benchmarks you can measure and adjust.

Next, translate those goals into a practical personal budget plan. The plan should balance discipline with flexibility, prioritizing essential needs, savings, and debt payoff. Incorporating a debt payoff plan into your budget helps you allocate extra payments consistently, while automated transfers to an emergency fund reduce friction and protect against life’s surprises.

From a personal budget plan to financial resilience: practical steps

A solid personal budget plan relies on an honest baseline: track income and expenses, distinguish essentials from discretionary spending, and set monthly targets for saving and debt reduction. Building this foundation makes your financial goals tangible and reduces the guesswork. Start with small, automatic contributions to an emergency fund, which serves as a safety net when unplanned costs appear.

To accelerate progress, pair your budget with a structured debt payoff plan. Decide whether you prefer the debt avalanche or the debt snowball approach, and integrate the chosen method with your spending plan. Regular monthly reviews ensure you stay aligned with changing circumstances, so your personal finance plan remains resilient and effective.

Frequently Asked Questions

What is a personal finance plan that works and how do you create it?

A personal finance plan that works starts with clear financial goals and a budgeting framework you can sustain. Begin by defining your financial goals (short-, medium-, and long-term) with specific targets. Build an income and expense baseline to know what you can reliably save each month. Choose a budgeting approach (50/30/20, zero-based, envelope, or pay-yourself-first) and tailor it to your life. Establish an emergency fund with automated, regular contributions, and attach a debt payoff plan (avalanche or snowball) if debt exists. Then expand to savings, retirement planning, and periodic reviews to stay on track as life changes. Use simple tools like a spreadsheet or budgeting app to track progress and keep discipline aligned with your values.

How can a personal budget plan support a debt payoff plan and help build an emergency fund?

A personal budget plan aligns spending with goals and stabilizes progress toward both a debt payoff plan and an emergency fund. Start with a realistic income and expense baseline, then allocate funds monthly to essentials, financial goals, and discretionary spending. Choose a budgeting method you can follow and automate transfers to savings and debt payments. Prioritize an emergency fund within the budget—aim for three to six months of essential costs and increase it over time. For debt payoff, apply either the debt avalanche (highest interest first) or debt snowball (smallest balance first) while continuing regular payments. Regular reviews keep the plan responsive to life changes and ensure steady progress toward both the emergency fund and debt payoff goals.

| Key Point | Description |

|---|---|

| Introduction / Core Philosophy | Crafting a plan that works relies on repeatable systems you can sustain, translating ambition into consistent action and aligning money with what matters to you. |

| Step 1: Define clear financial goals | Set short-, medium-, and long-term targets; write them down with specific numbers; ensure goals reflect your values and provide benchmarks for progress. |

| Step 2: Baseline income and expenses | Gather 30–60 days of data; identify fixed, variable, and occasional costs; determine how much you can reliably save each month. |

| Step 3: Choose a budgeting approach | Pick a sustainable method (e.g., 50/30/20, zero-based, envelope, pay-yourself-first) and structure a budget around essentials, financial goals, discretionary spending, and sinking funds. |

| Step 4: Build an emergency fund | Aim for 3–6 months of essential expenses; automate regular contributions; start with at least one month if you’re just beginning. |

| Step 5: Debt payoff plan (if applicable) | Use avalanche or snowball strategies; integrate extra payments into your budget to accelerate payoff and reduce interest. |

| Step 6: Savings, investments, and retirement | Prioritize retirement accounts and employer matches when available; create dedicated savings for mid-term goals; allocate funds consistently. |

| Step 7: Review and adjust | Schedule regular check-ins (monthly and annual); adapt to life changes using data, not emotion, to stay on track. |

| Step 8: Tools and resources | Leverage spreadsheets, templates, budgeting apps, alerts, and educational content to simplify tracking and progress. |