Small business finance is the backbone of sustainable growth for many small enterprises today. Effective small business cash flow management ties revenue timing to expenses and funding, helping owners see when to reinvest or conserve cash. A reliable cash flow forecast lets you predict upcoming gaps, plan borrowing, and align spending with expected inflows. When growth and liquidity clash, evaluating options like small business loans helps you choose financing that fits your forecast and repayment capacity. Smart use of working capital financing and a clear path to business growth financing keeps your strategy proactive rather than reactive.

From a broader lens, financial planning for small businesses emphasizes liquidity, capital allocation, and prudent risk management. Alternative terms such as cash flow planning, access to credit facilities, and growth capital reflect the same objective: turning financial data into actionable strategy. By focusing on visibility into receipts and outlays, governance practices, and scalable funding options, you frame sustainable expansion without getting bogged down in jargon.

Small business finance: Essentials for Cash Flow, Loans, and Growth

Small business finance is more than securing capital; it’s a discipline built on robust cash flow management. By prioritizing small business cash flow management, owners can forecast inflows and outflows, recognize seasonality, and maintain liquidity to cover expenses and seizing opportunities. A practical approach centers on a cash flow forecast that translates numbers into actionable decisions, ensuring you have visibility into when to reserve funds or access working capital financing to bridge gaps.

With a clear picture of liquidity, you can responsibly evaluate financing options like small business loans and lines of credit. Differentiate debt that drives growth from debt that merely funds operations, and consider a blended strategy that combines working capital financing for day-to-day needs with business growth financing for strategic bets—such as equipment, capacity expansion, or market entry—so each dollar supports long-term value.

Leveraging Cash Flow Forecasts and Working Capital Financing for Sustainable Growth

A reliable cash flow forecast is the cornerstone of proactive management in small business finance. Build a rolling 90-day forecast and refresh it monthly, incorporating best-, expected-, and worst-case scenarios to reflect seasonality, promotions, and investment plans. This forecasting discipline helps you spot potential shortfalls early and decide whether to tighten receivables, extend payables strategically, or access working capital financing when needed.

Beyond forecasting, align finance with growth strategy through business growth financing that supports scaling initiatives. Define milestones, revenue targets, and unit economics, and ensure transparent financial statements to build lender and investor confidence. A blended capital structure—combining equity, debt, and targeted working capital financing—can optimize the cost of capital while preserving cash flow stability and accelerating sustainable expansion.

Frequently Asked Questions

What is small business finance, and how does a cash flow forecast support working capital financing?

Small business finance is the strategic management of cash flow, debt, and growth funding to keep liquidity and enable operations. A cash flow forecast projects expected inflows and outflows over the next 30–90 days, helping you spot gaps early and decide when to use working capital financing or small business loans. This proactive approach links liquidity planning to strategic decisions, supporting seasonal needs and growth plans.

What financing options should a small business consider for growth financing while maintaining healthy cash flow?

To fund growth while protecting cash flow, evaluate options that fit your forecast and goals. Growth financing can include small business loans, lines of credit, working capital financing, or invoice financing, chosen based on cost and timing. Align any debt with your cash flow forecast and strategic milestones, and consider a blended capital structure (debt plus equity) to balance risk and upside.

| Aspect | Key Points |

|---|---|

| Cash Flow & Core Pillars | Cash flow is the lifeblood of small business finance; forecast inflows and outflows, manage working capital, and plan for seasonal fluctuations to keep operations running smoothly. |

| Cash Conversion Cycle | The cash conversion cycle is the time it takes to convert investments in inventory into cash from sales; a shorter cycle improves liquidity and reduces reliance on external borrowing; monitor bottlenecks like slow-paying customers and excess inventory. |

| Forecasting Cash Flow | Forecasting cash flow projects inflows and outflows for 30–90 days (longer for strategic planning); base forecasts on historical data and planned actions; regularly update to spot shortfalls and adjust spending. |

| Working Capital & Cash Reserve | Working capital equals current assets minus current liabilities; strong working capital enables opportunistic investments and resilience; best practices include lean receivables, optimized payables, inventory control, and building a cash reserve. |

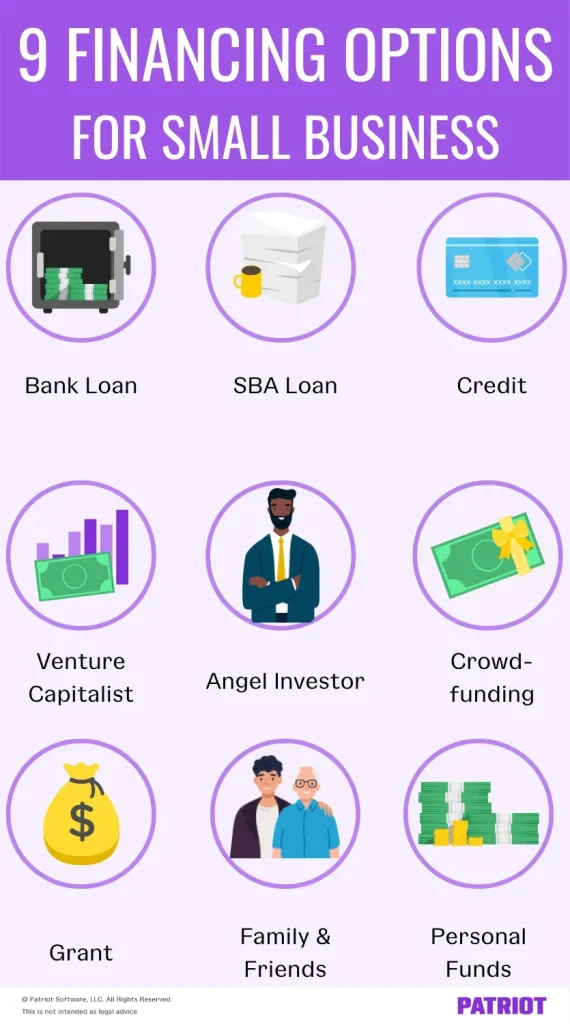

| Financing Options | Capital to fill gaps between inflows and outflows; choose debt types that support growth rather than just covering operating gaps; options include small business loans, lines of credit, working capital loans, invoice/receivables financing, and SBA-backed loans. |

| Debt Management & Cost of Capital | Compare offers and terms; maintain a prudent debt load; fixed payments can stabilize budgeting and reduce risk; ensure funds are aligned with revenue cycles and growth plans. |

| Growth Financing | Align capital with strategic expansion plans; options include equity, venture debt, or debt facilities; require milestones, robust cash flow forecasts, and transparent governance. |

| Risk Management | Protect cash flow and credit standing; manage interest rate risk, supplier disruptions, and customer concentration; build resilience with reserves and diversification; consider hedging or fixed-rate financing. |

| Practical Steps | Build a rolling 90‑day cash flow forecast; tighten receivables and offer early payment discounts; optimize payables; create a working capital cushion; regularly evaluate financing options; align finance with strategy; invest in financial systems. |

Summary

Small business finance is a dynamic discipline that blends cash flow management, prudent lending choices, and growth-oriented financing. By mastering cash flow forecasting, strengthening working capital, and selecting the right mix of loans and growth funding, you can build a resilient financial engine that supports sustainable expansion. In the practice of Small business finance, turning financial data into actionable decisions aligns capital with strategy and helps prepare for market fluctuations. With disciplined planning and a clear growth path, your business can thrive while maintaining liquidity and strong financial health.