Startup funding is a crucial element for the growth of emerging companies, especially across the vibrant landscape of Australian startups. Recently, venture capital activities have surged in the region, with AI startups leading the charge in innovation and market disruption. From sophisticated AI-driven retail solutions to healthcare technologies, tech startups are leveraging significant investments to enhance their products and scale operations. Fundraising announcements have highlighted impressive rounds of financing, showcasing the confidence investors have in the innovation emerging from Australia. As these startups secure millions, the potential for future growth and positive economic impact within the continent seems bright.

The quest for financial backing has become increasingly vital for fledgling businesses, particularly in the tech sphere. With the influx of capital, new ventures are not only able to innovate but also disrupt traditional markets across various sectors, including eCommerce and health. In Australia, the emphasis on early-stage investments and seed funding is shaping a promising future for many emerging firms. Such financial support allows these companies to refine their offerings, attract top talent, and ultimately reach new markets. As we delve into the weekly highlights of funding activities, the spotlight remains on how these financial dynamics are driving the startup ecosystem forward.

Significant Startup Funding Trends in Australia

Australia is becoming a hotbed for startup funding, particularly in sectors driven by technological advancements. This week, we saw several major fundraising announcements, reflecting a trend toward supporting innovation in AI and tech startups. With an increasing number of venture capital firms looking to invest, Australian startups are positioned to harness this favorable climate. The surge in financial backing highlights the confidence investors have in the potential of these emerging companies.

From sizable investments in established companies like Zyft to the support of new ventures through platforms like Antler, the funding landscape is diverse. The emphasis on AI and digital health presents a broader narrative about where Australian startups are headed. As the market matures, it’s crucial for entrepreneurs to not only secure funding but to have a clear vision and strategy for growth, ensuring they can meet investor expectations and sustain momentum.

Venture Capital’s Influence on Australian Startups

Venture capital plays a pivotal role in the growth of Australian startups, particularly in sectors harnessing artificial intelligence and tech innovations. Companies like Zyft and BlinkLab exemplify how VC funding can accelerate product development and growth trajectories. These investments not only provide crucial capital but also offer strategic guidance and networking opportunities that can be invaluable for fledgling enterprises. As we dive deeper into this week’s funding landscape, it’s evident that smart capital is seeking innovative solutions that resonate with current market demands.

Moreover, venture capital firms like Antler are not just focusing on established players; they are nurturing a new generation of startups tackling various challenges across multiple sectors. This approach is crucial for fostering a thriving ecosystem, allowing emerging companies to capitalize on their unique insights and technological capabilities. Investing in diverse startups strengthens the overall economy and positions Australia as a key player in the global tech landscape.

The Rise of AI Startups in Australia

The funding announcements this week underscore a booming interest in AI startups across Australia. Companies like Zyft and the health-focused BlinkLab showcase how artificial intelligence can innovate industries from retail to healthcare. The influx of capital into these startups is a reflection of the growing recognition of AI’s potential to transform business operations and consumer experiences. As these companies harness advanced technologies, they become critical players in their respective markets.

Furthermore, initiatives led by venture capital firms like Antler indicate a strategic focus on nurturing AI-driven solutions. Supporting eight emerging startups, Antler recognizes the expansive opportunities within the AI sector. The diversity in applications—from fintech, healthcare to robotics—illustrates a comprehensive approach to exploiting machine learning and AI technologies. This trend is likely to continue as investors seek out startups capable of delivering innovative solutions that meet the demands of a rapidly evolving marketplace.

Funding Success Stories: Spotlight on Australian Startups

In the world of fundraising announcements, success stories often emerge, showcasing the impact of well-timed investments. For instance, Zyft’s recent $7.5 million funding round illustrates how the right backing can propel a startup’s growth and valuation. With plans to enhance its product offerings and expand its presence in the retail sector, Zyft demonstrates the potential that substantial financial support can unlock for Australian startups. This type of success not only encourages further investment but also inspires other entrepreneurs to pursue their visions.

Similarly, the case of Fluency, which secured $1.5 million in a pre-Seed round, highlights the importance of community support and innovation hubs in nurturing startup talent. The recognition it received through awards at Swinburne’s Innovation Studio played a crucial role in attracting early-stage investors. These narratives not only celebrate the achievements of individual companies but also illustrate the collaborative nature of Australia’s startup ecosystem, where experience, mentorship, and funding converge.

Navigating Startup Fundraising Announcements

For aspiring entrepreneurs, navigating the complex world of fundraising can be daunting. Understanding the dynamics of fundraising announcements and how to position for investment is crucial for success in the startup environment. Investors are increasingly looking for startups that articulate clear value propositions and demonstrate potential for scalable growth. Keeping an eye on the funding announcements each week provides insights into investor preferences and highlights emerging trends in the startup ecosystem.

Moreover, the ability to craft a compelling narrative around a startup’s mission and product can significantly increase chances of securing funding. Companies like BlinkLab and Antler-backed projects exemplify how strong pitches and innovative ideas resonate with investors. For startups, aligning their vision with market demands and backing it up with data-driven strategies can enhance their appeal to venture capitalists and other funding sources.

Emerging Opportunities in the Australian Tech Landscape

The Australian tech landscape is brimming with opportunities for startups, particularly within the AI sector. The current wave of funding demonstrates a strong investor appetite for innovative solutions that solve real-world problems. As seen with BlinkLab and Zyft, there is a significant push towards integrating AI technologies into everyday applications, signifying a major shift in how businesses operate. This opens doors for new entrants looking to disrupt traditional markets with smarter technology.

Moreover, established venture capital firms are increasingly seeking to partner with promising startups that can deliver cutting-edge solutions. This cooperation between new startups and experienced investors is essential for realizing the full potential of technology in various sectors. Keeping abreast of funding trends and understanding where the market is heading can help entrepreneurs seize emerging opportunities and foster a culture of innovation within the Australian startup community.

The Role of Indigenous Startups in Australia’s Economy

Indigenous startups are carving a significant niche in Australia’s economy, contributing to the diversity and richness of the entrepreneurial landscape. Recent funding announcements reflect this trend, as these startups secure investments that not only bolster their business models but also promote cultural practices and sustainable practices. The unique perspectives that these organizations bring to the table can lead to innovative solutions that cater specifically to their communities while offering broader applications.

Moreover, the rise in investments directed towards indigenous startups indicates a growing recognition of their potential impact on socio-economic development. By supporting these businesses, investors are not only fueling growth but also fostering inclusivity within the startup ecosystem. As such, indigenous startups are becoming a vital component of Australia’s overall economic landscape, demonstrating that leveraging unique cultural insights can lead to successful market entries and sustainable growth.

Future-Proofing Australian Startups through Strategic Funding

As the startup environment becomes increasingly competitive, future-proofing through strategic funding is paramount. Companies like Zyft and BlinkLab, which have recently secured significant investments, exemplify the importance of leveraging funding to enhance capabilities and scale operations. By making informed choices about how to allocate these resources, startups can position themselves for long-term success while navigating challenges in their respective markets. This foresight in capital management is critical in today’s fast-paced economy.

Additionally, staying informed about funding opportunities and the evolving landscape of venture capital can empower startups to make strategic decisions. Aligning their growth plans with market trends and investor interests allows them to secure not just initial funding, but also subsequent rounds that will help them scale. Such proactive approaches to fundraising ensure that they are well-equipped to meet the demands of an ever-changing market, ultimately contributing to sustainability and resilience in the startup ecosystem.

Harnessing the Power of Community and Collaboration in Startups

Successful startups are often those that harness the power of community and collaboration. As seen with the recent achievements of Fluency and other emerging companies, building strong networks and partnerships can be instrumental in gaining access to funding. By collaborating with other entrepreneurs, incubators, and investors, startups can combine resources and knowledge, fueling innovation and growth. This collective approach is increasingly recognized as a key driver of success in the competitive startup environment.

Furthermore, initiatives that promote community engagement often lead to stronger mentorship opportunities, which are invaluable for emerging entrepreneurs. Understanding how to leverage community resources can enhance the capabilities of startups, providing them with insights and guidance that are critical for navigating the challenges of early-stage growth. As such, fostering collaborative environments within the startup space can transform individual ambitions into community successes, leading to a robust and vibrant startup ecosystem.

Frequently Asked Questions

What are the recent fundraising announcements for Australian startups in AI and tech?

Recent fundraising announcements highlight significant investments in Australian startups, especially in the AI sector. For instance, Zyft secured $7.5 million for its AI-driven retail solutions, while BlinkLab raised $7.66 million for its digital health initiatives. Antler has also backed eight AI-focused Australian startups, emphasizing the growth of innovation in the tech startup landscape.

How can Australian startups leverage venture capital for growth?

Australian startups can effectively leverage venture capital by attracting investments that support scaling operations and enhancing product offerings. Venture capitalists like Antler provide funding coupled with strategic guidance, enabling startups to innovate and gain market traction. This support is crucial for startups in competitive sectors like AI and tech.

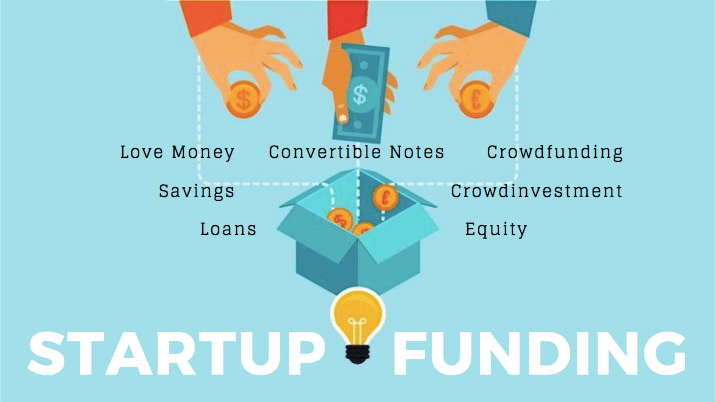

What funding options are available for tech startups in Australia?

Tech startups in Australia have several funding options, including venture capital, angel investments, and government grants. Platforms like Antler focus on nurturing early-stage startups in the AI space, while private funding rounds, as seen with Zyft’s recent $7.5 million raise, are crucial for immediate capital needs.

What role does AI play in the fundraising process for startups?

AI plays a pivotal role in the fundraising process for startups by enhancing their business models and attracting investors. For instance, startups like BlinkLab are developing AI-powered solutions, which can demonstrate significant market potential, making it easier to secure funding from venture capitalists and other investors.

What are some specific challenges faced by Australian AI startups in securing funding?

Australian AI startups face several challenges in securing funding, including intense competition for limited venture capital, the need for robust proof of concept, and the necessity to navigate complex regulatory environments. Startups like Fluency benefitted from mentorship and support networks to overcome these challenges and attract funding, highlighting the importance of community in fundraising efforts.

How do fundraising announcements impact the Australian startup ecosystem?

Fundraising announcements significantly impact the Australian startup ecosystem by building credibility and driving investor interest. Successful rounds, such as the $7.5 million raised by Zyft, not only validate the startup’s concept but also invite further investment into the ecosystem, further benefiting tech startups and fostering innovation.

What should Australian startups consider before announcing their fundraising rounds?

Before announcing fundraising rounds, Australian startups should consider their valuation, the strategic use of funds, and market conditions. Clear communication of their business model and growth strategy, as demonstrated by ventures like BlinkLab, can attract investors and position the startup effectively in the market.

What are the latest trends in startup funding for AI innovations in Australia?

The latest trends in startup funding for AI innovations in Australia include a strong emphasis on long-term investment strategies, as demonstrated by Antler’s support of multiple AI-focused startups. Additionally, there is an increasing interest in sectors like digital health and fintech, driven by the potential for AI to enhance operational efficiencies and customer experiences.

| Startup | Funding Amount | Use of Funds | Key Focus Area |

|---|---|---|---|

| Zyft | $7.5M | Enhance AI capabilities, expand user base, new monetization strategies | AI-driven retail in Australia |

Summary

Startup funding is pivotal for entrepreneurs looking to bring innovative ideas to life, as evidenced by the recent wave of successful fundraising initiatives. Notably, Australian startups are propelling forward with significant investments in various sectors, notably AI. The successful fundraising rounds reported this week highlight the strong interest and potential for growth in startup ecosystems, especially in technology and health-focused innovations. This trend underlines a vibrant and supportive landscape for startup funding that is crucial for fostering innovation and economic growth.