Startup funding has become an increasingly vital aspect of the entrepreneurial landscape, fueling the dreams of innovators and creators around the globe. With the right financial backing, budding businesses can transform brilliant ideas into successful enterprises, often drawing attention from venture capital news and angel investing circles. Recent fundraising announcements have highlighted the significant investments flowing into the startup ecosystem, showcasing an array of industries from tech to healthcare. As investors diligently seek out the next big startup success stories, the landscape becomes more competitive, compelling entrepreneurs to refine their pitches and strategies. Navigating the complexities of startup investment is crucial for those looking to make their mark and grow in a vibrant marketplace.

When discussing the essential financial support for fledgling companies, terms like entrepreneurial financing and early-stage capital often come to mind. These funding avenues are not just about raising money; they represent a critical lifeline for entrepreneurs aiming to bring their innovative visions to fruition. The buzz surrounding various fundraising initiatives offers insights into emerging trends within the investment sphere, encouraging widespread participation from both local and global investors. As we explore the landscape of venture funding, it’s evident that strategic investments can significantly alter the trajectory of new ventures, propelling them toward success in an ever-evolving market.

Overview of Recent Startup Funding Trends

The landscape of startup funding has experienced significant shifts in recent years, particularly with a surge in venture capital investments. Fundraising announcements from the past week underscore this vibrant trend, highlighting a growing appetite among investors to back innovative startups. For instance, companies such as Outset Ventures, which has closed its Fund II at NZ$41.5 million, showcase how venture capital firms are attracting a multitude of investors, signaling renewed confidence in the startup ecosystem.

Additionally, the participation of government-backed funds like NZ Growth Capital Partners demonstrates a broader strategy aimed at fostering entrepreneurship. With a focus on sectors like deep tech, medical technology, and energy startups, investors are increasingly keen on funding ventures that promise transformative breakthroughs. This indicates not only a thriving venture capital scene but also a variety of fundraising avenues including angel investing and corporate venture positions.

Frequently Asked Questions

What are some recent startup funding announcements in 2025?

Recent startup funding announcements include Outset Ventures, which closed a NZ$41.5 million fund II, exceeding its target significantly. AI video analytics startup Unleash Live raised $17 million in Series B funding, and Vively, a metabolic health platform, secured a $1.6 million seed round. These highlights reflect growing interest in startup investment across various sectors.

How does venture capital influence startup success stories?

Venture capital plays a critical role in startup success stories by providing essential funding and resources that accelerate growth. For instance, companies like Rocket Lab and LanzaTech, backed by Outset Ventures, exemplify how strategic startup funding can lead to significant technological breakthroughs.

What is angel investing and how does it benefit startups?

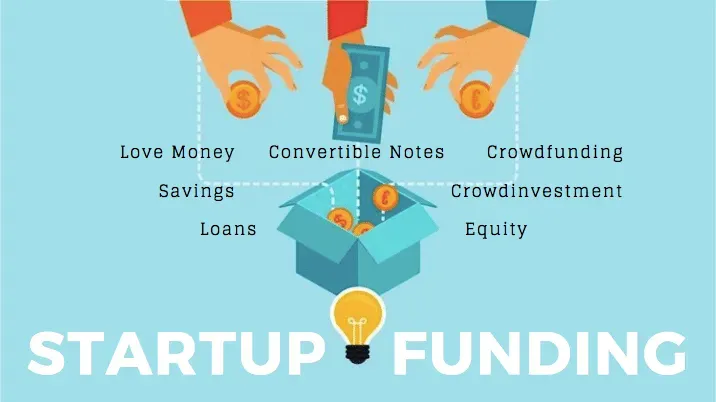

Angel investing involves high-net-worth individuals providing capital to startups in exchange for equity or convertible debt. This form of startup funding not only supplies necessary financial support but also connects entrepreneurs with valuable industry insights and networks, enhancing the chances of success.

What trends are emerging in startup investment in 2025?

In 2025, there is a marked increase in venture capital funding for AI and tech-driven startups, evidenced by the significant rise in GenAI VC deals in the US. With total funding surpassing $50 billion within the first five months, the competition and interest in tech startups continue to grow, reflecting a thriving startup investment landscape.

How do fundraising announcements impact investor interest in startups?

Fundraising announcements serve as vital indicators of a startup’s credibility and potential for growth, often attracting further investor interest. For example, when Vively announced its $1.6 million seed round, it not only secured funding but also positioned itself favorably in the competitive landscape of metabolic health, which can lead to additional investment opportunities.

What role does government support play in startup funding?

Government support significantly enhances startup funding by providing matching investments or grants that lower the risk for private investors. For instance, NZ Growth Capital Partners’ contribution of $15 million to Outset Ventures’ Fund II demonstrates how public resources can catalyze private investment, fostering innovation in startups.

What should startups consider when seeking venture capital?

Startups seeking venture capital should consider factors such as alignment with investor goals, scalability potential, and the strength of their business model. A compelling startup narrative, backed by data-driven metrics, can attract venture capitalists looking for promising investment opportunities in emerging sectors.

How can I keep up with the latest venture capital news and startup funding trends?

To stay informed about venture capital news and startup funding trends, follow reputable financial news outlets, subscribe to newsletters, and leverage platforms like LinkedIn, Twitter, and specialized startup news websites. These resources often provide timely updates on fundraising announcements and investment opportunities.

| Startup | Funding Amount | Purpose/Focus | Investors |

|---|---|---|---|

| Outset Ventures | NZ$41.5 Million | Supporting New Zealand startups in science and engineering | 150+ Investors, NZ Growth Capital Partners |

| Patriot Resources | $2.2 Million | General capital raise | Existing shareholders, Institutional investors, High-net-worth individuals |

| Standards Australia (Kungari) | $3.8 Million | Pre-seed investment in CalcTree | Foundamental, Suffolk Technologies, Antler VC, Autodesk, Bentley employees |

| Unleash Live | $17 Million | AI video analytics for workplace safety | JR Investment, Previous investors (Patagorang Investment Group, Amaysim co-founders, Revel Partners) |

| Vively | $1.6 Million | Metabolic health platform funding | Archangel Ventures, Bupa Ventures |

| GenAI VC Gap | Growing US-China VC gap | – | – |

Summary

Startup funding continues to evolve, as evidenced by the recent funding announcements highlighted this week. With various companies, from Outset Ventures raising funds to support deep tech enterprises to Unleash Live focusing on AI video analytics, the landscape is vibrant and competitive. The notable differences in venture capital investments between the US and China also indicate that the startup funding scene is diversifying and expanding rapidly in some regions while slowing in others. Understanding these trends is crucial for entrepreneurs looking to secure financing, as they illustrate the opportunities and challenges inherent in today’s startup ecosystem.