Startup News and Venture Capital are reshaping how founders navigate growth, funding strategies, and strategic pivots in today’s fast-changing business world. As venture capital trends 2025 unfold, investors increasingly emphasize unit economics, defensible moats, and differentiated business models. For entrepreneurs, staying current with startup funding news and VC investment news helps tailor pitches and align product roadmaps. Readers benefit from startup ecosystem updates and early-stage funding insights that translate headlines into practical strategies. This article explores fresh signals at the nexus of startup news and venture capital for 2025 and beyond.

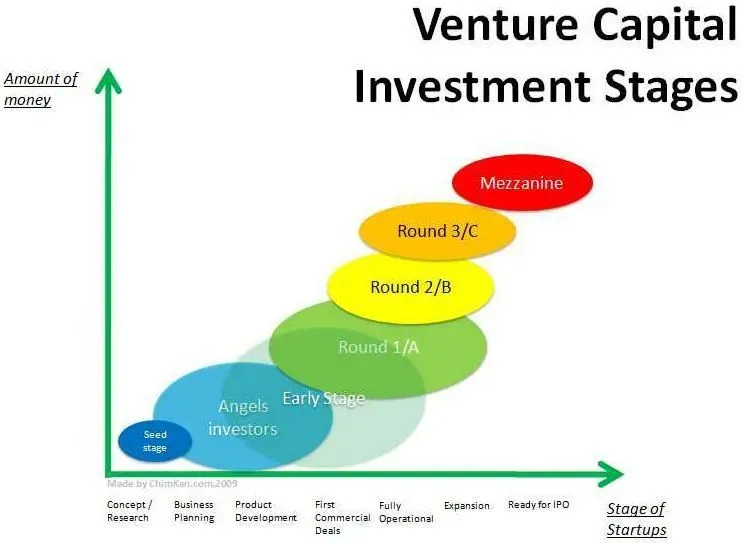

Within the broader financing landscape for young companies, the funding climate is shaped by investor appetite, the mechanics of fundraising rounds, and the evolving rules of growth capital. The startup funding ecosystem is seeing capital inflows directed toward differentiated models, sector-specific plays, and sustainable unit economics, with growth equity and late-stage commitments aligning to clear paths to profitability. Stakeholders should monitor syndicated rounds, lead investor dynamics, and cross-border activity as indicators of demand and confidence. By reframing these signals through the lens of alternative terms—seed and Series activity, scaling capital, and the capital markets for emerging ventures—readers gain a more resilient view of where opportunity lies and how to position for the next cycle.

Startup News and Venture Capital: Decoding 2025 VC Investment News and Market Signals

In today’s dynamic environment, tracking Startup News and Venture Capital reveals how capital is flowing and where investor attention lands next. The venture capital trends 2025 report points to continued emphasis on differentiated business models, profitability paths, and defensible moat structures, while startup funding news highlights high-profile rounds and strategic alliances that can signal platform effects or regulatory tailwinds. As founders digest these signals, they can refine their value proposition, align product roadmap with unit economics, and time fundraising windows more precisely.

From a reader’s perspective, interpreting VC investment news means looking beyond headline sizes to the structure of rounds: syndicate formation, lead investors, and the rationale like geographic expansion or product diversification. This is complemented by startup ecosystem updates that reveal how teams leverage data, network effects, or proprietary tech to create defensible advantage. In 2025, macro conditions and capital availability shape valuation trends and deal velocity across stages, making early-stage funding insights crucial for early traction and go-to-market timing.

Sector Focus and Strategy: Leveraging Startup Ecosystem Updates and Early-Stage Funding Insights

Across sectors, fintech, healthtech, AI-enabled platforms, and sustainability ventures remain focal points in VC investment news, with sector-specific dynamics affecting regulatory considerations, reimbursement models, and cloud adoption rates. Understanding venture capital trends 2025 and startup funding news helps founders frame product-market fit, pricing, and go-to-market milestones to match investor appetite.

Investors and founders can use these signals to craft a disciplined approach: monitor deal velocity, explore opportunities in hot lanes while identifying sustainable monetization paths, and balance bold bets with proven investment theses. By combining startup ecosystem updates with early-stage funding insights, teams can plan for multiple funding rounds, prepare credible runway projections, and engage investors with a compelling narrative aligned to the latest VC investment news.

Frequently Asked Questions

What are the key takeaways from venture capital trends 2025 for startups seeking funding?

Current venture capital trends 2025 show more differentiation, sector specialization, and a measured growth approach with a stronger emphasis on unit economics and path to profitability. In startup funding news, rounds are evaluated for strategic rationale—geographic expansion, product diversification, or platform effects—and for the strength of defensible moats. VC investment news also highlights syndicate dynamics and lead investor choices, indicating where capital is flowing. For founders, focus on a defensible value proposition, solid unit economics, and a credible path to profitability, while timing fundraising with market windows and aligning product development to investor expectations. Early-stage funding insights emphasize product-market fit, scalable go-to-market, and transparent monetization plans.

Which signals in startup funding news are most important for founders planning their next fundraising round?

Key signals in startup funding news include burn rate, runway, gross margin, MRR, and CAC, which reveal growth potential. Look for syndicate formation, lead investor choices, and the strategic rationale behind rounds, such as geographic expansion or regulatory positioning. Startup ecosystem updates highlight defensibility through data advantages, network effects, or proprietary technology, shaping how VC investment news translates into valuations and deal speed. For founders, early-stage funding insights stress a clear product-market fit, a scalable GTM plan, and transparent monetization, paired with up-to-date macro context to anticipate funding cycles in venture capital trends 2025.

| Section | Key Points |

|---|---|

| Introduction |

|

| Section 1: The current landscape of startup funding and VC investment |

|

| Section 2: Interpreting startup funding news and the signals investors care about |

|

| Section 3: Sector and market patterns shaping venture activity |

|

| Section 4: Practical guidance for founders and investors |

|

| Section 5: The role of media, transparency, and responsible reporting |

|

| Conclusion |

|

Summary

Table presents a structured summary of the base content, highlighting the key ideas across Introduction, five main sections, and the conclusion. The table emphasizes the interrelation between startup activity and venture capital, interpretation of signals, sector patterns, practical guidance, and the media’s role in shaping a healthy ecosystem. The accompanying conclusion reinforces how Startup News and Venture Capital informs strategic decision-making for founders and investors while stressing accountability, transparency, and ongoing trend analysis for sustained growth in 2025 and beyond.