What really impacts your credit score is a nuanced question, and understanding it helps you separate myths from reality. Too many credit score myths focus on one-off moves, while the real picture comes from consistent behavior—the factors impacting credit score, such as timely payments and controlled debt. Two core levers are payment history importance, which tracks every on-time or late payment across accounts, and the credit utilization ratio, which looks at how much of your available credit you’re using at any given time. If you’re asking how to improve credit score, start by building reliable payment patterns, reducing revolving balances, and avoiding heavy new-credit activity that can signal risk to lenders. By framing your decisions around steady habits rather than dramatic swings, you can see meaningful, lasting progress across your credit profile.

Viewing the topic through a broader lens, you can describe it as your credit health and overall creditworthiness, not just a single score. LSI-driven terms such as score determinants, payment behavior patterns, and data signals help map related ideas like responsible borrowing and timely bills to a healthier profile. The core signals behind the number include how reliably you meet obligations, how much you use of your available credit (utilization), and how long your revolving history has been established. By focusing on consistent actions—on-time payments, prudent utilization, and steady history—you align with how modern scoring models assess risk and potential reward, making the path to improvement clearer. This broader, semantically connected approach helps readers and search engines alike understand the topic from multiple angles. If you map your actions to these related ideas, you can design a more resilient plan for building a solid credit profile over time.

What really impacts your credit score: Debunking myths and understanding the core drivers

What really impacts your credit score is a question that many people ask. It’s a composite snapshot of your credit behavior over time, not a single event, and myths about credit scores spread quickly. Understanding the true drivers helps you separate the ‘credit score myths’ from reality and focus on the factors that actually influence your score.

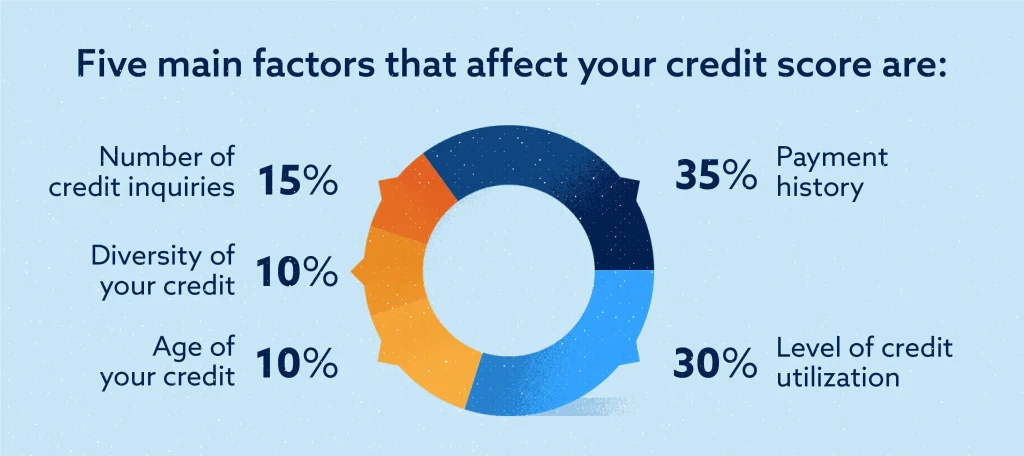

Key factors include payment history importance, amounts owed (credit utilization ratio), length of credit history, new credit inquiries, and your overall credit mix. Among these, payment history and utilization typically carry the most weight in most scoring models, while other elements add nuance. By looking at how you manage on-time payments and how close you run to your limits, you can chart a course to gradual improvement over time.

How to improve credit score: practical steps aligned with proven factors impacting credit score

If you’re asking how to improve credit score, start with solid fundamentals. Review your credit reports for errors on AnnualCreditReport.com, set up autopay to protect payment history, and keep your credit utilization ratio low by paying down balances before the cycle closes. These actions target the most influential factors and align with the guidance on how to improve credit score.

Other practical moves include avoiding unnecessary hard inquiries by limiting new credit, preserving older accounts to extend the length of credit history, and diversifying credit types only when it makes sense. Monitor for fraud and inaccuracies to protect reporting accuracy, because errors can depress your score even when your behavior is sound. By applying these habits consistently, you move beyond myths and build a resilient credit profile.

Frequently Asked Questions

What really impacts your credit score: what are the key factors driving it?

What really impacts your credit score are the factors impacting credit score that reflect your long‑term credit behavior. Core elements include: payment history importance, how much you owe relative to your limits (credit utilization ratio), length of credit history, new credit and hard inquiries, and credit mix. Payment history importance is typically the strongest driver, so on‑time payments across all accounts matter most. Practical steps: keep utilization low (below 30%, ideally under 10%), avoid opening too many new accounts, regularly review your credit reports for errors, and keep older accounts open if possible to lengthen history.

What really impacts your credit score and how can you improve it?

What really impacts your credit score and how can you improve it? Start by focusing on the main drivers with these steps: check your credit reports for errors, ensure on‑time payments (set autopay), manage credit utilization by paying down balances and keeping utilization low, avoid impulsive new credit, maintain older accounts to preserve the length of history, and consider a strategic mix of credit if you have few types of accounts. These actions align with the idea of how to improve credit score over time and can produce lasting gains.

| Key Point | What It Means for Your Score | Practical Takeaways |

|---|---|---|

| Payment history and payment patterns | Most influential factor; on-time payments build score; late payments hurt. | Set up autopay and reminders to ensure on-time payments across all accounts. |

| Amounts owed and credit utilization | Utilization ratio signals risk; lower is better; high balances relative to limits can drag your score. | Keep overall utilization under 30%; aim for under 10% where possible; pay down balances and consider strategic pay-down timing. |

| Length of credit history and account age | Longer, well-managed histories generally support higher scores. | Keep old accounts open if feasible; avoid unnecessary new accounts that shorten average age. |

| New credit and hard inquiries | New applications trigger hard inquiries; clustering can temporarily lower your score. | Limit new credit; if shopping for big loans, do so within a focused window to minimize impact. |

| Credit mix and total number of accounts | A diverse mix can have a modest positive effect, but it’s usually smaller than payment history or utilization. | Only diversify when needed and manage each account responsibly rather than opening accounts for score gains. |

| Errors, fraud, and reporting accuracy | Inaccuracies or fraudulent activity can unfairly depress your score. | Regularly monitor credit reports, dispute inaccuracies promptly, and protect against identity theft. |

| Practical steps to improve what really matters | Actionable framework built around core drivers. | Check reports for errors, automate payments, manage utilization, limit new credit, maintain old accounts, diversify responsibly, and monitor identity protection. |

Summary

What really impacts your credit score is the ongoing pattern of your credit behavior over time—the combined influence of timely payments, prudent utilization, length of history, and careful handling of new credit. This descriptive overview explains that no single event defines your score; instead, credit models weigh consistent habits across multiple data points. Understanding these factors helps you avoid common myths, make informed decisions, and build a stronger financial foundation. To improve what really impacts your credit score, focus on sustainable actions: pay on time, keep balances manageable, limit new credit, maintain old accounts, diversify only as needed, and monitor reports for accuracy. With patience and disciplined habits, you can gradually strengthen your credit profile and enjoy greater financial flexibility.